Samco Mutual Fund is all set to enter the mutual fund industry by launching their first ever fund - Samco Flexicap Fund which is open for subscription from Jan 17th, 2022 to Jan 31st, 2022.

Investment Objective: The investment objective of the scheme is to provide capital appreciation by investing in an underlying fund of equity and equity related instruments. The fund will invest across market caps without any restriction.

Benchmark: NIFTY 500 TRI

Samco's vision in the mutual fund industry

The fund-house's vision and aim with the Samco Flexi Cap Fund is to run the best stress-tested active equity fund in India and by the best they mean, a fund that can generate high consistent risk-adjusted returns for long periods of time.

A unique fund management process

Stress-tested investing

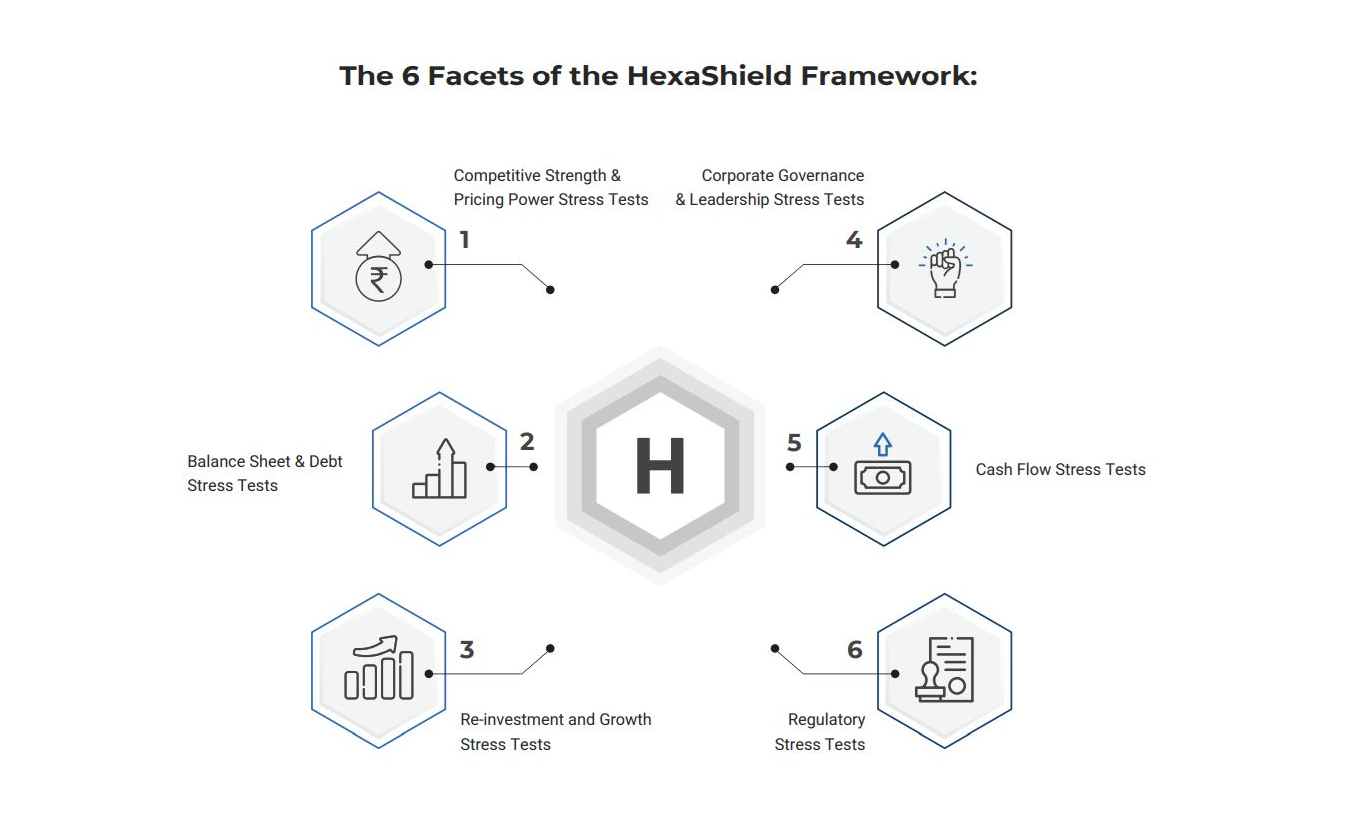

- The companies are put under a series of rigorous metrics and tests and only the most resilient out of the lot are selected as part of the fund's stock universe. The company uses the 6-step Hexashield framework to evaluate companies

After applying this framework to 67,000+ companies around the globe, only 125+ companies make it to Samco's investable universe,

Out of these 125+ companies, the fund will construct a portfolio of 20-25 efficient companies. The company defines a efficient company as below

- Companies with a high ROCE

- Companies with low debt

- Companies that can sustain these high ROCE's and low debt levels across cycles

Once a company qualifies as an efficient company, the fundhouse will try to purchase it at an efficient price.

The fundhouse has also specified a restricted list, detailing the kinds of companies they will not invest in:

- No PSUs

- No cyclicals

- No heavily leveraged companies

- No capital intensive businesses

- No investment fads

Based on our analysis, we have observed the following pros and cons

Pros:

- No restriction on market caps. The ability to adjust the portfolio based on market valuations of different categories

- Lower in risk due to rigorous stress-testing process

- Exposure to global stocks as well

- Valuation driven approach can also reduce risk.

- Significant deviations from the benchmark providing ample scope for alpha generation

Cons:

- The final portfolio will be a 25 stock portfolio, which is quite concentrated in comparison to peer flexicap funds. This can give tremendous scope for outperformance but can also lead to higher downside.

A flexi cap fund is safer than pure mid and small cap funds at these valuations. SIP's are the preferred mode of investment in this fund. Investors who are comfortable with short term volatility and want high alpha over a 5 year period can consider adding a small allocation to their portfolio.

It is of utmost importance that the fund should be discussed with your financial advisor and then ascertain whether it is suitable to invest. Always read the scheme documents fully before investing.