SEBI has recently released a circular which brings about changes to the manner in which NAV is allocated for certain Mutual Fund investments. This is effective Feb 01, 2021. You can read the circular - Click here.

What exactly does this circular mean and how does it affect investors?

Let us first understand how the payment process works for Mutual Fund investments. When an investment is made the amount is first debited from the investor's bank account, goes to the payment gateway/clearing account and is then transferred to the bank account of the Mutual Fund. In case of AssetPlus the money goes to the account of Indian Clearing Corporation Limited (owned by Bombay Stock Exchange). This does not happen instantly and can take time anywhere between few minutes to few days depending upon the reconciliation process of the bank and ICCL.

The existing process of NAV allocation

For investments in Mutual Funds upto Rs. 2,00,000 that are not in "Liquid" category, the Mutual Fund companies until now allotted the same day NAV irrespective of whether the money has been received by them or not.

For example, an investment of Rs. 1,00,000 in ABC Mutual Fund at 11 am on 21st December 2020 would have fetched the NAV of 21st itself - even if they payment gateway transferred the money to ABC Mutual Fund after a day or two. If for some reason the payment did not reach them, they would reverse the transactions afterwards.

The new process of NAV allocation

From 1st February 2021 onwards, all the transactions across different categories will be allotted NAVs only when the Mutual Fund companies receive the money in their bank account.

How will this affect investors?

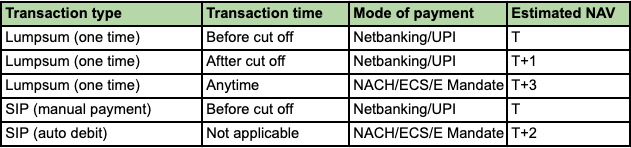

The investors might receive a later day's NAV based on their bank and mode of payment. We have done an estimation of how the NAV allotment would look post implementation.

T = day when the transaction is initiated. The cutoff times are the standard timings prescribed for different category of Mutual Funds.

To summarise, the change will have an effect on investors making investments of larger values (Rs. 2,00,000 or more). The NAV of allotment could differ by a day or two compared to the existing practice. This change would not affect the investments in any manner and is more operational in nature.

Please note that since this change is applicable for the entire industry (and not just AssetPlus) there could be some minor deviations in NAV allotment until March 2021. By then we can expect all industry stakeholders (RTAs, AMCs, BSE, AssetPlus etc.) to have streamlined the complete process.