Nippon India AMC is launching an NFO, which is set to open for subscription from Feb 4th, 2021 and closes on Feb 12th, 2021.

Investment Objective: To generate wealth over the long term, suitable for investors having a moderate to high risk appetite.

Investment Strategy: The fund emphasizes on select 20 blue-chip stocks from Nifty 50. Stocks are filtered based on several factors such as ROCE, P/E, P/B and Dividend Yield and there is no bias given to any specific sector or stocks. The focus is to create returns which are sustainable in the long run. The portfolio is diversified across various sectors but concentrated in stock selection.

Fund Manager: Mehul Dama

Benchmark: Nifty 50 Value 20 TRI

Minimum Lumpsum Investment Amount: Rs 5,000

Minimum SIP Investment Amount: Rs 100

Fund Management Process:

- Selection criteria is purely from Nifty 50.

2. Quantitative metrics used for selecting stocks:

- Low Price to Earnings(P/E)

- Low Price to Book(P/B)

- High Dividend Yield

- High Return on Capital Employed(ROCE)

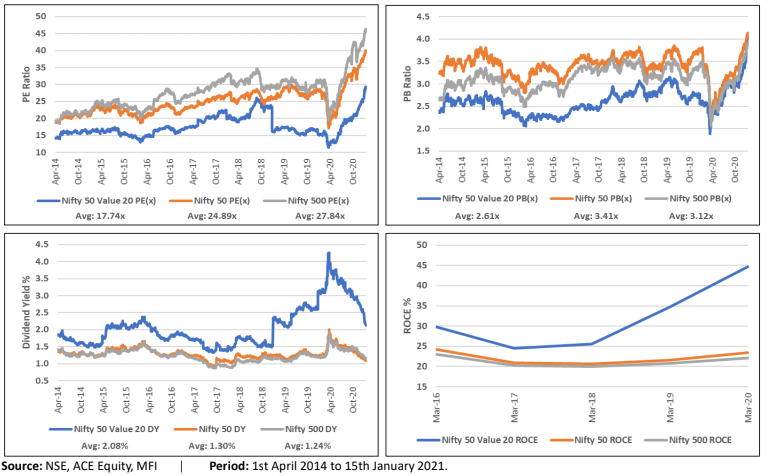

Below are the graphs which depict the various above mentioned metrics of Nifty 50(Orange), Nifty 500(Grey) and Nifty 50 Value 20(Blue). As visible from the graphs, the fund stays true to its ideology by having a significantly lower P/E and P/B while having a much higher Dividend Yield and ROCE when compared to Nifty 50 and Nifty 500.

3. A single stock cannot exceed 15% of the portfolio.

4. The fund undergoes rebalancing after every year it completes.

Based on our analysis, we have observed the following pros and cons

Pros:

- No Fund Manager Bias or Human Intervention

- Focuses only on top companies which are highly liquid

- No Exit Load

- Sector Agnostic

- Low Cost as it is Index Based

Cons:

- Limited to just Nifty 50 Universe

- Highly concentrated as it invests in a maximum of 20 stocks

- Restricted to Value style of Investing

- Cannot take active calls like holding cash in a portfolio

This fund does not have an active fund management but focuses more on quantitative metrics which have proven to have worked well. Although this concept of investing is still new to our country, one can allocate a small amount of their portfolio towards this fund as a tactical allocation. But it is still necessary that the fund should be discussed with your financial advisor and then ascertain whether it is suitable to invest. Always read the scheme documents fully before investing.