What is an SIP?

An SIP (or a Systematic Investment Plan) is a smart and easy way to invest in Mutual Funds. SIP allows you to invest a fixed amount on a monthly basis. It is a planned approach towards investments that helps you develop a discipline of regular investing and create more wealth over the long term. It is similar to an EMI where you pay monthly instalments to the bank. The difference is that in an SIP you invest the money on a monthly basis for your financial goals.

How does an SIP work?

Let us check how an SIP works with an example. Say you are starting an SIP of Rs. 1000 in a Mutual Fund on 1st date. Then on 1st of every month Rs. 1000 will be auto-debited from your bank account and invested in the fund.

For every instalment, you will receive units of the fund that is added to your account. These units are purchased at different prices depending upon the price of the Mutual Fund (also known as NAV) on the 1st of every month.

Hence, investors starting an SIP benefit from both compounding and lesser risk.

Compounding - The eighth wonder

Also called as the eighth wonder of the world by some is the power of compounding. When you invest for a long term and earn returns on the returns earned by your investment, your money would start compounding. Compounding refers to a simple rule - the sooner you begin investing, the more your money grows with time. Let us understand this with an example.

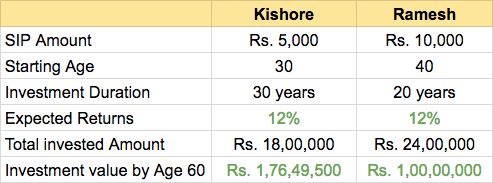

Kishore started investing Rs. 5000 in SIP at the age of 30. He planned to invest till his retirement at 60. Ramesh started investing Rs. 10000 in SIP at the age of 40. He plans to retire at 60.

Let us assume the returns in both the cases are 12%

Even though Kishore is investing a smaller amount every month he has created more than twice of Ramesh’s wealth by starting early.

What are the advantages of SIPs?

1. Disciplined investing

SIPs ensure that you invest regularly and helps you develop the habit of investing. Disciplined investing is one of the first steps towards attaining your financial goals.

2. Convenience

SIP is an easy way to invest in Mutual Funds. You just need to complete a one time online registration with your bank to start an SIP.

3. Wealth Creation

When you invest in an SIP over long term, you can accumulate significant wealth. An SIP of Rs. 1000 for 20 years can provide more than Rs. 25 lakhs.

4. Flexibility

SIPs do not have any lock-in period, which means you can cancel or redeem the investments anytime. You can also increase or decrease the SIP amount and duration.

Investing in an SIP has proven to be one of the best ways to create wealth for an investor and is also convenient and hassle free. A well planned SIP ensure that despite market turbulences, you are able to average your returns over the long term.