Equity Shares, Fixed Deposits and in recent years Cryptocurrency are few investment options that are well known and widely invested in. Mutual Funds on the other hand are still relatively a new concept which are associated with the tagline “Mutual Funds are subject to market risks”.

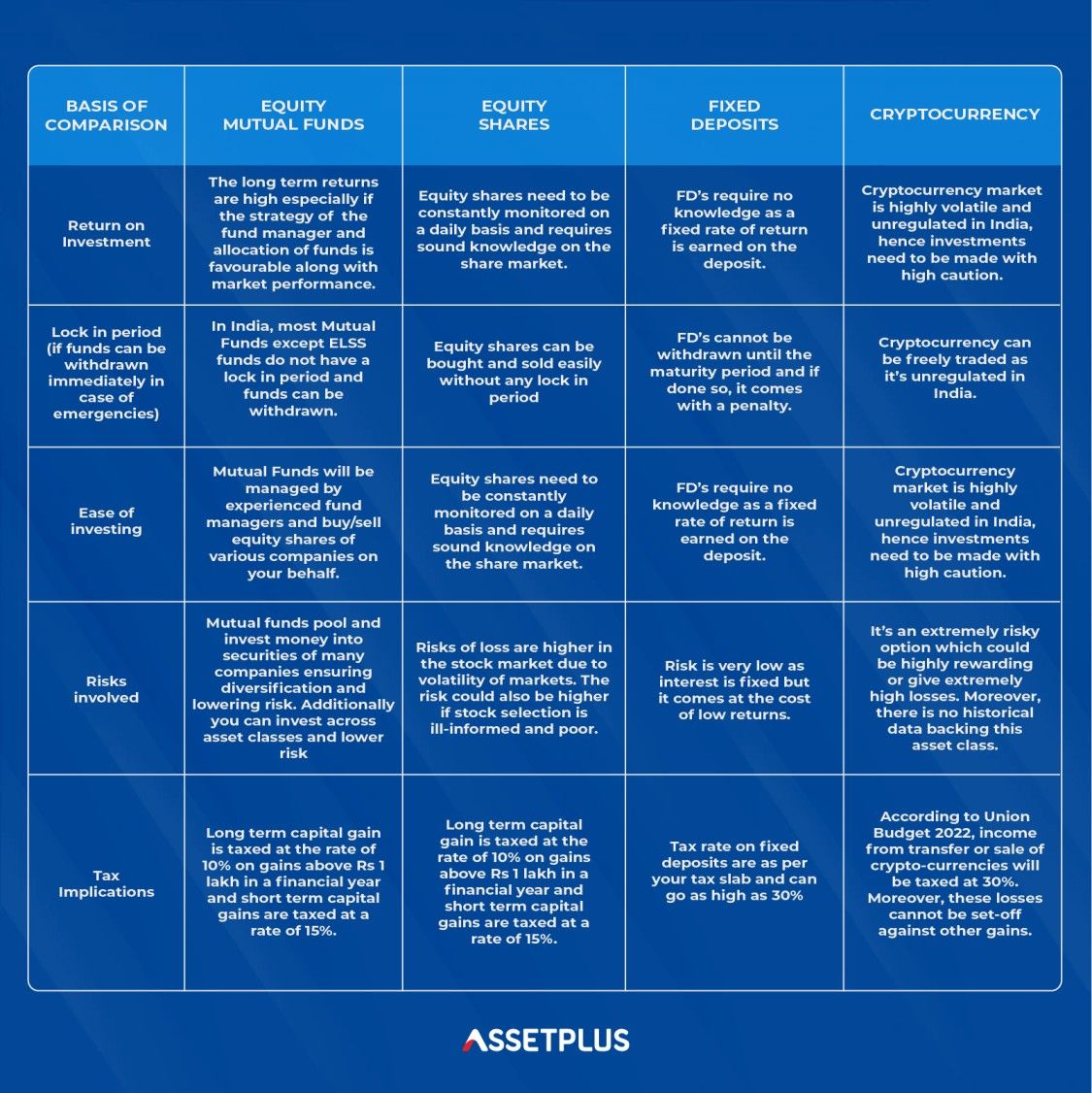

To better understand the key advantages of mutual funds, let’s draw a comparison between Mutual Funds, Equity Shares, Fixed Deposits and Cryptocurrency using various metrics.

So, why should you invest in Mutual Funds right now?

1)Compounding and wealth creation

Let’s say you invest 10,000 every month in a SIP(Systematic Investment Plan) and you earn 12 % return. You continue doing this for 10 years. After 10 years, the amount you invested would be 12 lacs. But this amount would have compounded and grown to 23 lacs. This is almost double the amount!

However, had you only invested for 3 years you would have given 3.6 lacs and only had 4.3 lacs at the end of 3 years. While, this is good - it is only a 20% higher amount. The earlier you invest, the more you benefit from the power of compounding.

2)Tackling Inflation

One of the best ways to fight inflation is to invest in long-term equity mutual funds. One must choose investment options that have the potential to generate a significantly greater rate of return to compensate for the inflationary decline in purchasing power and hence savings.

For example, if you invest 10,00,000 in a lump sum using which you can buy 1000 dresses. After 10 years ,the value of money decreases and you can buy only 500 dresses with 10,00,000. After investing assuming you receive 12 percent returns , you have 31,00,000 which is 3X the initial investment and can purchase 1550 dresses thus fighting inflation and having higher spending power as well.

3)Liquidity

Most mutual funds do not have a lock in period and you can easily withdraw your funds in case of any emergency which provides liquidity.

4)Flexibility

Based on your need, risk profile and investment horizon - you can choose which mutual fund to invest in. This could be debt, equity, commodities, hybrid, etc.

5)Diversification

Mutual funds spread your investment into various shares of different companies belonging to different industries while diversifying your funds to reduce risks and provide high returns in the future as well.

6)Expert management

For a someone with limited knowledge, having a fund manager invest according to your future goals and risk profile is an added advantage since it reduces time and effort in meeting our future financial goals, be it buying a new car or retiring before 40.

Choosing the right advisor to invest your funds is the key to growing your wealth and achieving your financial goals through mutual funds.