Invesco India AMC is launching a NFO, which is set to open for subscription from Jan 24th, 2022 and closes on Feb 7th, 2022.

Investment Objective: To generate wealth over the long term, suitable for investors having a moderate risk appetite who are comfortable with volatility in the short term.

Investment Strategy: As the name suggests, the fund will invest in a completely flexible manner across all areas of the market based on opportunities, namely Large, Mid and Small cap stocks which are winners in their respective sectors. The fund follows an approach which emphasizes on investing in High Growth-High Quality and also Turnaround Companies. The fund will invest at least 65% of its portfolio in Equity and Equity oriented investments and the remaining 35% can be in any other Equity market cap/Debt Instruments or Cash. The focus is to create returns which can outperform the benchmark by active fund management with no restrictions in any specific market size/cap.

Fund Manager: Taher Badshah and Amit Nigam

Benchmark: S&P BSE 500 TRI

Minimum Lumpsum Investment Amount: Rs 1,000

Minimum SIP Investment Amount: Rs 500

Fund Management Process:

- The Fund follows an active management with the expectation to generate alpha over the long term.

- Investment universe is majorly from S&P BSE 500.

- Fund will shortlist companies which satisfy the following:

- High Growth

- High Quality

- Turnaround Phase

4. No specific bias to any sector overall but preference will be towards structural growth drivers and cyclical tailwinds

5. No specific bias to market capitalization and will be periodically revised based on opportunities.

6. Portfolio will undergo rebalancing actively and dynamically based on valuations, economic and market conditions.

Opportunity:

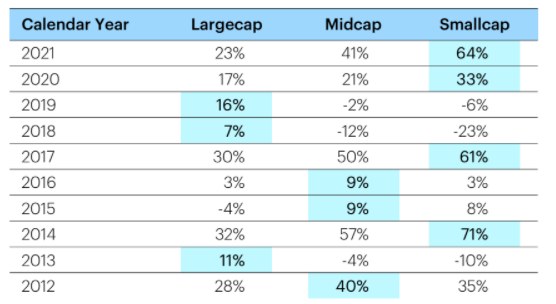

The nature of markets is volatility and every single sector or the segment reacts differently in different time periods. A flexi-cap strategy attempts to make the most of all the opportunities present in the market, without having any bias or preference to a specific segment/size/sector.

Diversifying across all the market capitalizations helps in not just providing consistent returns but also provides limited scope for severe underperformance as opposed to a traditional market cap based equity mutual fund which is completely mandated to its respective category.

Based on our analysis, we have observed the following pros and cons:

Pros:

- Completely Market Capitalization Agnostic

- Experienced fund management with an approach which is highly process driven

- Completely Sector Agnostic

- Relatively more stable and consistent with lower drawdowns

- Dynamic style investing with flexibility to shift across market caps based on opportunity as there are no restrictions

Cons:

- Can lead to over diversification

- Relatively new style of investing with very less track record

- No specialization in any particular market segment

This fund is backed by an able fund management with able process driven approach which has been successful in delivering solid returns. History has repeatedly shown us that no single category has the ability to be at the top at all points of time, hence using a flexi-cap approach would be ideal for a moderate risk investor to get the best of all flavors of the market. It is of utmost importance that the fund should be discussed with your financial advisor and then ascertain whether it is suitable to invest. Always read the scheme documents fully before investing.