SBI Mutual Fund has launched an NFO, which is open for subscription from August 12th, 2021 to August 25th, 2021.

Investment Objective: The investment objective of the scheme is to provide capital appreciation by investing in an underlying fund of equity and debt instruments which is rebalanced periodically.

Benchmark: CRISIL Hybrid 50+50 – Moderate Index TRI

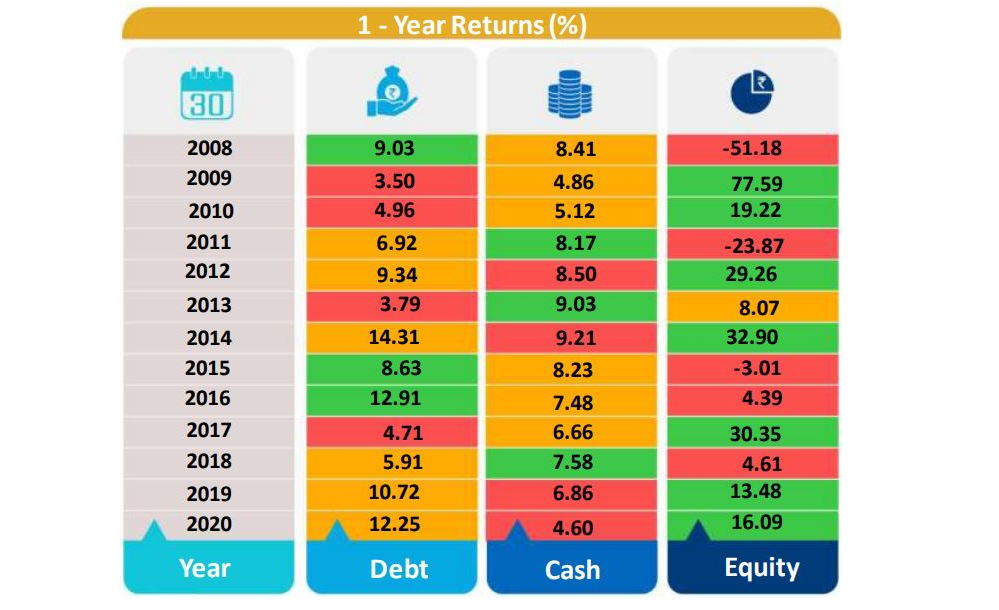

The need for asset allocation

Even though, pre-dominant equity allocation is important for long-term wealth creation, winners keep rotating between asset classes. Since it is tough to time the market, asset allocation ensures that you get consistent returns year on year

Fund Management Process:

STEP 1: Deciding the right asset allocation

- Sentiment metrics in the market like mutual fund flows, retail investor participation as well as valuation metrics like P/E ratio, P/B ratio, bond yield spread will be used to determine the equity levels in the portfolio

- Fundamental factors like GDP growth, macro indicators of growth will also be used to determine range in which equities will be allocated.

STEP 2: Determining portfolio strategy

- This will include determining if the portfolio will have a value/growth approach, which market cap will get more preference (large, mid and small) and which sectors will get most allocation.

- These factors will be determined using a quantitative framework which takes into account valuation, market trends and growth potential.

STEP 3: Stock/Security Selection

- Stock selection is backed by strong research, analysis and the high-conviction ideas are shortlisted.

- Debt portion is managed with a strong preference to high credit quality papers in order to maintain liquidity.

Based on our analysis, we have observed the following tax advantages and who the fund is suitable for:

Tax Advantage:

Debt Funds

< 3 years - Slab Rate

> 3 years - 20% with indexation

Balanced Advantage Funds

< 1 year - 15%

> 1 year - 10%

Balanced Advantage Funds are taxed lower than debt funds even though they hold debt making it more tax efficient than holding debt funds and equity funds separately.

In addition, investors pay taxes and possible exit loads each time they redeem debt/equity fund to rebalance portfolios. In a balanced advantage fund, no taxes or fees are paid for internal rebalancing.

Why should you invest?

- The ability to generate more consistent positive returns year on year instead of extreme return scenarios like 20% loss in a year and 30% gain in another.

- Low volatility and risk as allocation is spread across different asset classes.

- The fund internally allocates between debt and equity based on valuation and historical data instead of investor's having to manually determine the allocation.

- Ideal for current high market valuations

- Tax efficiency

- Long term wealth creation over 3+ years

The last year in the markets has been an exuberant one. However, such periods are often followed by stagnant or negative returns. There is no way to avoid this but the volatility levels can be minimised.

It is necessary for long term equity investors to continue allocating to equity at all market levels for optimal compounding and wealth creation. A good strategy to continue doing this while also reducing drawdowns and periods of negative returns is to invest in such hybrid funds.

"You only have to do a very few things right in your life so long as you don't do too many things wrong" - Warren Buffet

It is of utmost importance that the fund should be discussed with your financial advisor and then ascertain whether it is suitable to invest. Always read the scheme documents fully before investing.