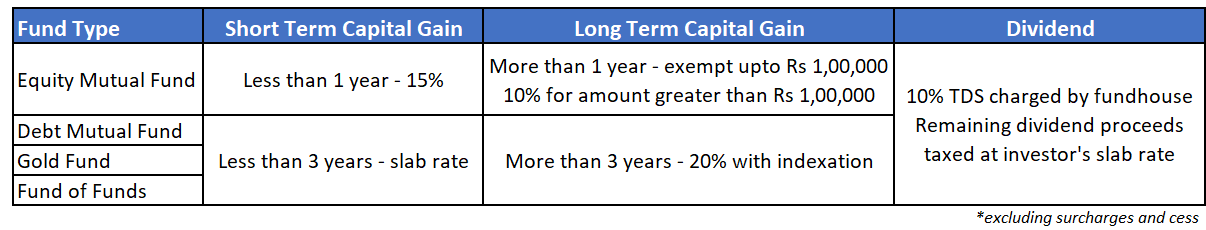

Investors have made superior gains in mutual funds in the last year. Many investors are taking advantage of the rally and booking profits and redeeming funds. An important criteria to factor in while booking profits from mutual funds is taxation.

How mutual funds are taxed?

Taxation for NRI’s

The tax rates applicable to NRI’s are the same as resident investors. The only point of differences arises that TDS is applicable for investments made by NRI’s, that is, the tax is deducted by the fund itself upon redemption and the remaining proceeds are given.

Wherever slab rates apply in taxation, tax is deducted at highest slab rate. Investors who fall under lower tax slabs can claim a tax refund while filing returns.

Understanding indexation

Indexation incorporates inflation in the cost of the investment. The cost is increased by the inflation yearly. Post 3 years, the tax is calculated on the indexed cost. A higher cost would mean lesser gains while calculating tax, hence lesser tax to be paid.

Simply, this means that if inflation has been 6% for 3 years and your debt returns have been 6% you will have to pay no tax. Even if inflation is lower than 6%, the effective tax rate is far lower.

This is the reason debt funds are more attractive than FD’s over a longer period.

Impact of new tax filing rules

As per Budget 2021, the government has announced that taxes on interest, capital gains and dividend income will be pre-filled in the income tax return. Investors who have previously missed paying taxes or did not identify dividend income in their returns cannot evade it going further. These points should be kept in mind while booking profits.

How to optimise your mutual fund investments for taxes

- If you fall in a tax slab equal or higher than 10%, then choose growth plans over dividend plans. If you need monthly income, opt for a SWP in a growth plan as an alternative.

- Choose debt funds over FD's for long term debt investments if you fall under a high tax slab. Debt fund taxes over 3 years are 20% and indexation further increases the benefit. In most cases, the effective taxation of debt funds does not exceed 8-9%, if held on for over 3 years.

- Book long term capital gains worth Rs 1,00,000 each financial year. Since the first 1,00,000 is exempt from taxes, booking this amount gives you tax-free capital gains each year. You do not need to use this amount and stop compounding, you can redeem it at the end of the financial year and re-invest into a different fund or the same fund, as per your adviser's guidance.

By booking gains today, you are prevented from paying future gains up until that amount of investment or NAV has been crossed again.

It is important to consult your financial advisor before making any investment decisions.