The past year has not been easy for Mutual Fund investors. Mutual Funds across categories, especially the high risk funds have provided a loss of upto 20%. Investors in Small Cap, Mid Cap and Sector funds have incurred the highest loss.

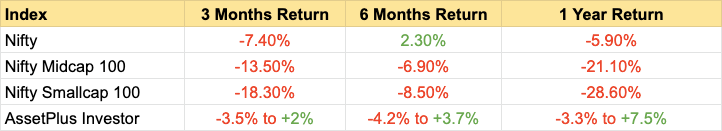

Investors who have planned their investments according to their personal goals, and have taken calculated risk have not been affected much. The data for comparison is provided below. We compare the returns of different benchmarks with actual returns obtained by investors whose portfolios are managed by us where we mention the least and highest returns received by investors during this period.

Over the past 18 months, our major focus has been to recommend conservative investments to safeguard portfolios. After a major bull run in 2017, it was highly unlikely that the markets will continue to provide higher returns again in 2018. Considering high prices at the end of 2017, we have taken a safer approach. This has also played out well for the investors given that their portfolios have been protected well.

Lessons from the past 1 year

- Investors who looked at past returns and invested for the future have taken the biggest losses. It is again clear that past returns do not guarantee or indicate what the future returns could look like. Funds that had past returns of +35% in 2017 have actually provided -20% returns between 2017 and 2019. We sincerely hope investors do not repeat this most common mistake

- Investing in Equity funds for short term can be dangerous. If your duration is less than 3 years, please stick to only debt funds. Even in debt funds, it is important to look at the underlying portfolio to decide the strength of the fund. Multiple debt and liquid funds have given upto -10% returns

- It is important to have a thorough risk profiling done to understand what level of risk can the investors withstand. Investors who didn’t realise the actual risk in investing have either redeemed their investments at a loss or stopped their SIPs, at a time when they should have increased their investments

- Active Portfolio review is important. Investing in a random set of Mutual Funds hoping for high returns in the future has never worked in the past, and will not do so in the future. Yet to see a Mutual Fund investor who has created wealth due to “hope”

Moving forward

Although there has been a visible slow down in many industries such as Automotive and NBFCs over the past year that have caused major drops in Mutual Funds, there are certain positive aspects that have emerged.

- The Finance Minister has provided a set of reforms that are expected to boost the economy

- The foreign investor tax that was introduced in the budget on July 5 has been removed, so there is good scope for foreign investors to invest in India again

- Lot of good stocks and Mutual Funds have been heavily oversold and are down by 20 - 35% in just 18 months

Based on the above factors, we see a possible recovery in the markets. Given the current low prices, it would be a right time to begin investing more aggressively in equity. Over the next 1 month, our advisors will reach out to all investors to conduct portfolio reviews wherein we would be recommending to move a portion of the investments from conservative to moderate/aggressive funds (Small & Mid-cap) subject to the following criteria

- The investor is personally comfortable to take a higher risk

- The financial goals allow for such high risks to be taken to obtain a higher return in the next few years

- The investor is looking at an investment duration of a minimum of 3 to 5 years.

At the end of the day, such a market downfall is not new and has happened multiple times before. Investors who have planned their investments and risks well in advance have had nominal losses that should be recovered quickly. Planning is the key.

If you have any questions, please feel to reach out to me at vishranth@assetplus.in. Our advisors are also available via live chat if you require any assistance.