What are the new taxation rules in Union Budget 2021 regarding Provident Funds?

The Union Budget 2021 proposed few regulatory and taxation changes. The most important among them was the new taxation laws on EPF and VPF contributions by employees.

Until now, provident funds were tax-free upon maturity. Effective from April 1 2021, EPF and VPF contributions above Rs 2,50,000 annually will be taxed at investor’s slab rate. Contributions upto Rs 2,50,000 will still be exempt from tax upon redemption.

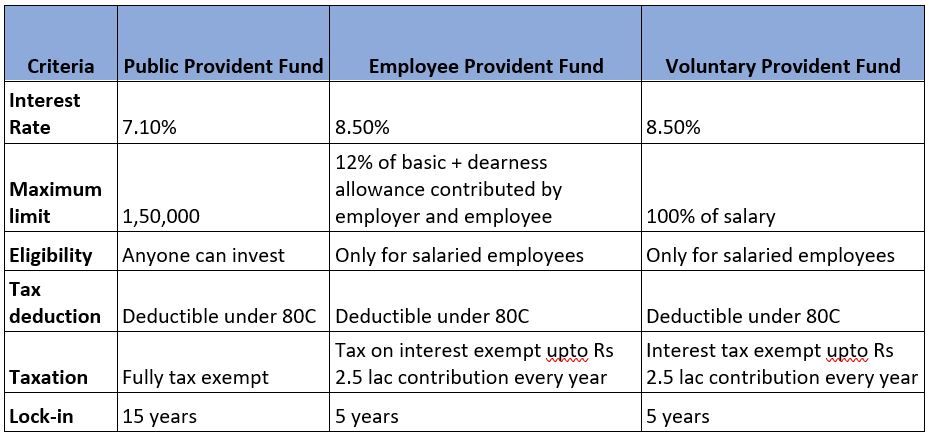

Let us understand the difference between PPF, EPF and VPF

How to know if the new rule applies to you?

PPF have capped the contribution limit to Rs 1,50,000 and hence do not fall under the new rules. Employees earning a salary above Rs 1,75,000 in basic plus dearness allowance monthly and contribute 12% to the Employee Provident Fund will fall under the new rules. These individuals will be contributing over Rs 2,50,000 every year to their EPF account. Individuals earning lesser than this amount but contributing more than 12% of their salary to VPF can also be applicable for this rule.

Another tool is to check your salary slips and check if the total of contributions to Employee Provident Fund and Voluntary Provident Fund is below Rs 2,50,000

What happens if the contribution is above Rs 2,50,000 annually?

Let us take the example of an investor who contributes

Public Provident Fund – Rs. 1,50,000

Employee Provident Fund – Rs. 2,50,000

Voluntary Provident Fund – Rs. 1,50,000

The total contribution in EPF and VPF is Rs 4,00,000. PPF contribution will not count in this calculation. Yearly interest on the first Rs 2,50,000 will not be taxed. However, interest on the additional Rs 1,50,000 will be taxed at the investor’s slab rate, say 30%. Currently EPF and VPF pay 8.5%. While this is a very good rate, post-tax returns will only be around 6%.

What is the alternative?

We suggest deploying the excess investment into asset allocated portfolios with equity component to gain higher tax-efficient returns over 5 or more years. Equities are taxed only at 10% long term tax. There is also no opportunity cost in doing so as provident funds would also lock-in the investments for minimum of 5 years.

You can consult your financial advisor to learn more about the new tax rule, its applicability to you and how to switch to more tax-efficient investments.