As the markets are in deep red over the past few weeks due to increasing fear of the novel coronavirus, some of us advisors were looking at case studies of how previous market crashes panned out in India.

The securities scam of 1992

For the market crash described here, we had to rope in a retired MF advisor to provide the inputs since none of the current advisors were active in the markets at that point!

This crash will be remembered by many veteran investors as the "Harshad Mehta crash/scam" which shook the stock markets starting March 1992. It started with a stock broker - Harshad Mehta - siphoning of Rs. 1,000 crore from the banking system to buy stocks on the Bombay Stock Exchange. The scam came to light when State Bank of India reported shortfall in government securities, and was eventually exposed in Aug 1992.

Back then, the only active Mutual Fund house was UTI which had launched a few schemes and Mutual Funds as an investment option were vastly unregulated.

How were the markets affected?

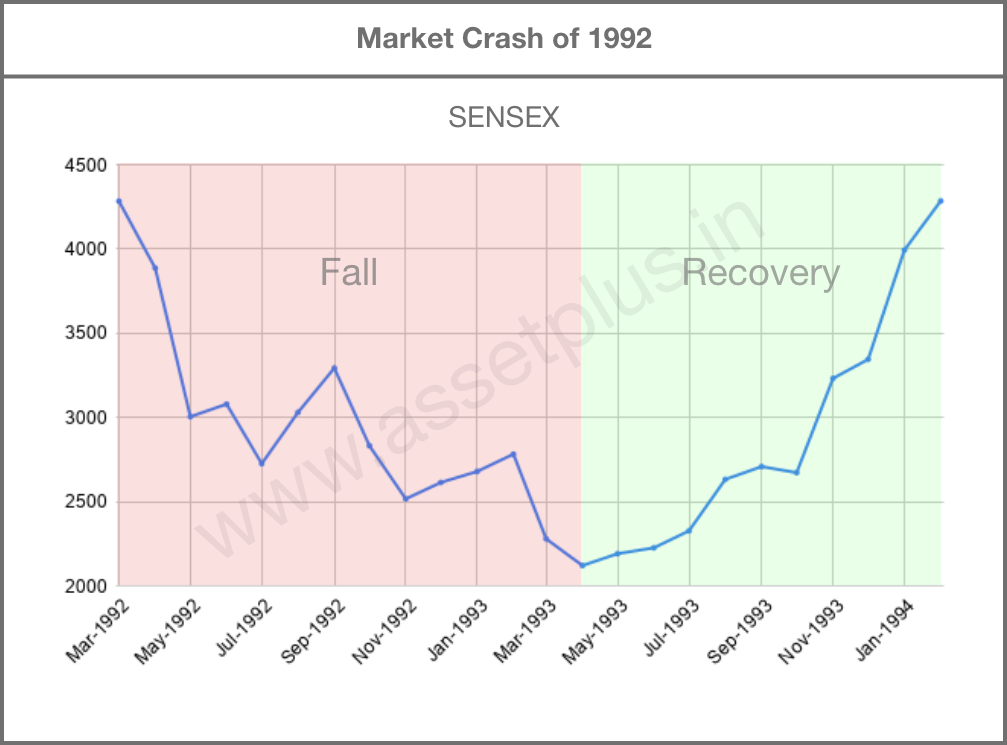

On Aug 6, 1992 when the scam was exposed, the markets crashed by over 50% leading to one of the biggest falls in the history of markets.

The fall was different from the current market fall in multiple aspects.

- The fall of 52% occurred over a period of an entire year, and the recovery took place in 10 months. This means that it was much more difficult for the investor to endure since it took place over a period of 22 months.

- The Indian economy back then was reeling under stress and India was hardly considered an economic powerhouse. At that particular point, it looked like India as an economy would cease to exist.

- Day after day, newspapers peddled negative news about how Indian markets were hit by a scam which spelled the destruction of the Indian economy as a whole. A country which hardly featured among the economic markets of the world was hit by a 50%+ crash - with some financial analysts suggesting that India & Sensex would not recover for as much as 10 years!

These were some of the challenges faced in 1992 which do not exist now.

When asked what was the most harmful aspect of the current market fall, the advisor replied with - Technology.

When an investor in 1992 invested for the long term, the technology was not advanced enough to give him a daily report of his investments. The only way investors got to know the state of their investments - were by annual reports sent via mail, or checking the latest share prices on the newspapers (which was tedious). In 2020 though, every investor has access to his portfolio 24x7 in their fingertips via a mobile app or a website.

How is technology a disadvantage?

Although there is no denying that technology has made it much easier for investors to invest in Mutual Funds, the downside is that it has also enabled investors with easy access to their portfolios. On top of this, the investors are subjected to mass media reports and whatsapp forwards most of which have unverified content that cause excess panic in the minds of investors. Due to this, many investors face an emotional dilemma, end up redeeming the investments or pausing them midway and forget that their financial goals are a long time away.

One of the major reasons that investors in the early 1990s and 2000s could make stellar returns in Mutual Funds was very simply that they were unable to track their investments. As per our analytics at AssetPlus, last week alone we had over 20,000 investors open their apps to track their investments! Investors should ideally track their Mutual Fund investments once a quarter.

What happened to the markets post the fall?

The markets completely recovered over the next 10 months in what is known as a V-shaped recovery. By mid 1993, multiple Foreign Institutional Investors (FIIs) had begun investing in India which sent the markets soaring. Sensex went up by a staggering 80% over the next 14 months, with many good quality stocks delivering returns of over 250% in under 2 years.

Lessons from the 1992 crash

- The first and foremost lesson for today's investor is that equity markets are always volatile. The 2020 fall due to Coronavirus is neither the first nor the sharpest fall in the markets. The stock markets and the Indian economy have seen multiple market falls in the past decades due to a host of different economic, health and military issues. And they will continue to see market falls in the future as well. This is inherent to the nature of stock markets and equity investments.

- In 1992, when the Indian economy was hardly of any repute we were hit with a 50% market crash and recovered within 18 months. In 2020, India is fast moving towards becoming a global economic powerhouse - coronavirus could be a serious threat at the moment but by next year it will be long forgotten. Indian economy and the world, will move on.

- Investors should ensure that they don't monitor their long term investments on a daily/weekly basis. For investors at AssetPlus, we have certified advisors monitoring their investments regularly and they will proactively inform the investor of changes required as well. But the changes are most likely not required on a weekly basis - Mutual Funds themselves are a long term investment

Most of all, please do not lose sight of what is more important. Your own life and safety of loved ones in the face of a global pandemic. Economy and markets will recover and prosper but no recovery can bring back lost lives. Please stay calm and take precautions. Stay away from large crowds and adopt proper hygiene measures. This too shall pass.

Meanwhile, let us stick to the investment plan, review and rebalance periodically, and work towards achieving our long term financial goals. Happy investing!