The past 15 days have been a roller coaster ride for most Mutual Fund investors, especially investors who are heavy in equity Mutual Funds. The novel corona virus spreading globally as well as the domestic issue of RBI placing a withdrawal limit on Yes Bank accounts have rattled the markets significantly. The steep fall has been mirrored in the global markets as well, with most of the global indices falling anywhere between 15 - 20% in the past few weeks.

So the question is - where are the markets heading and what should investors do?

Where are the markets heading?

Unfortunately, the answer to this question is the usual uninformative - it is not possible to predict the markets.

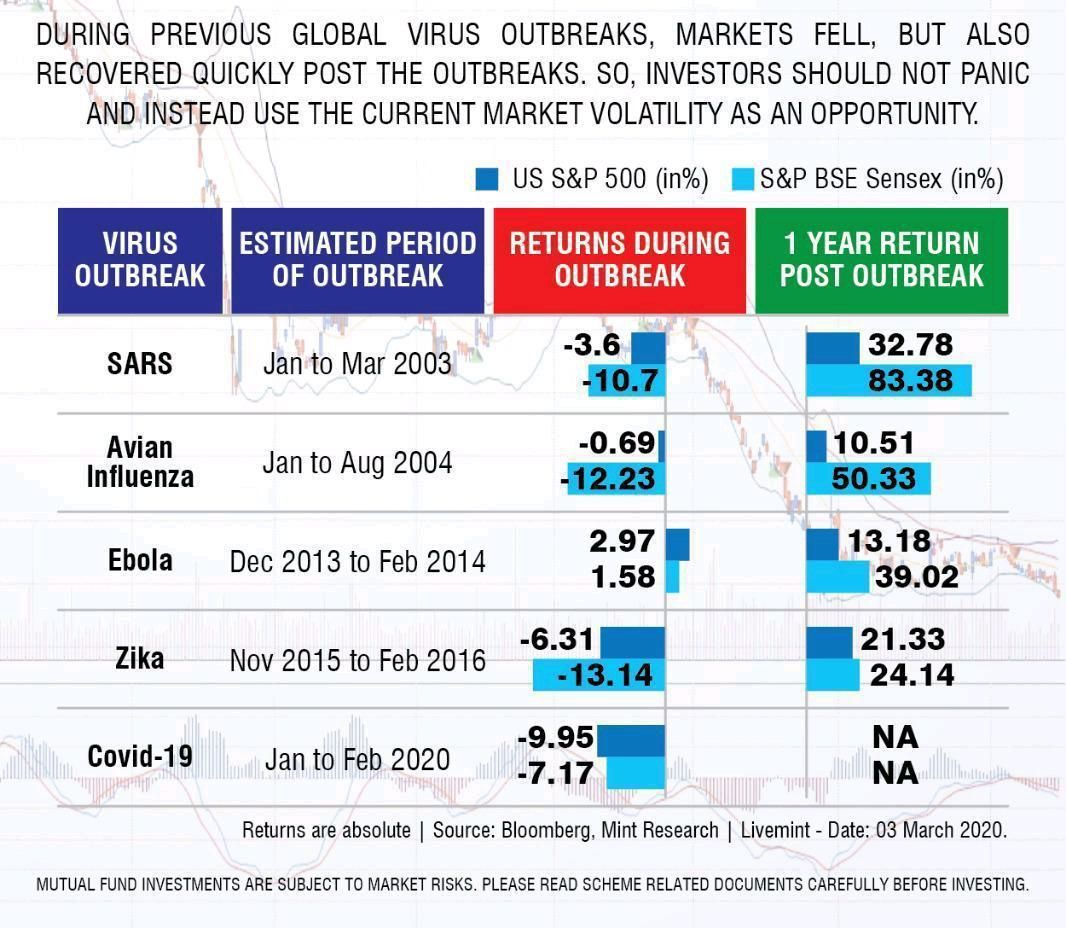

Past performance is not indicative of future performance. Nevertheless, let us look to history for a guide on how markets fared during previous outbreaks.

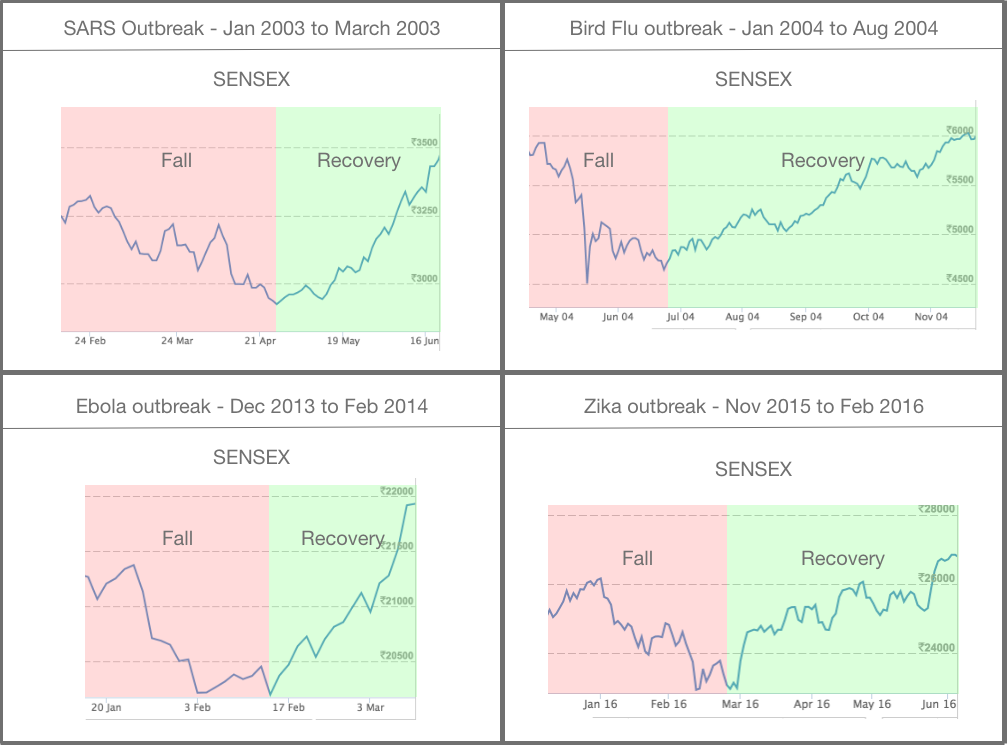

What history tells us is that most outbreaks are immediately met with panic selling in the markets. The knee jerk reactions have only increased with time as more and more of the population is exposed to multiple sources of social media which make it difficult to retain emotional control in the minds of investors. History also tells us that such panic selling is quickly followed by a V-shaped recovery - and the markets generally have boomed further in the following months once sanity prevails.

For the team of over 50 advisors at AssetPlus, this is likely the 2nd or 3rd virus outbreak and the umpteenth negative news we are witnessing. Here are few instances when past outbreaks resulted in panic selling and how markets recovered soon after.

What should investors do?

For long term investors this would be a non-event which means that like in the case of past events, Corona virus will be long forgotten in the next few years. Investors know equity is associated with volatility and risk, but knowledge alone would not be sufficient. This is the right time to take rationale decisions and ensure emotions don't interfere with your investments. Here is a list of do's and don'ts we recommend to our investors.

Do's

- Stick to your investment plan

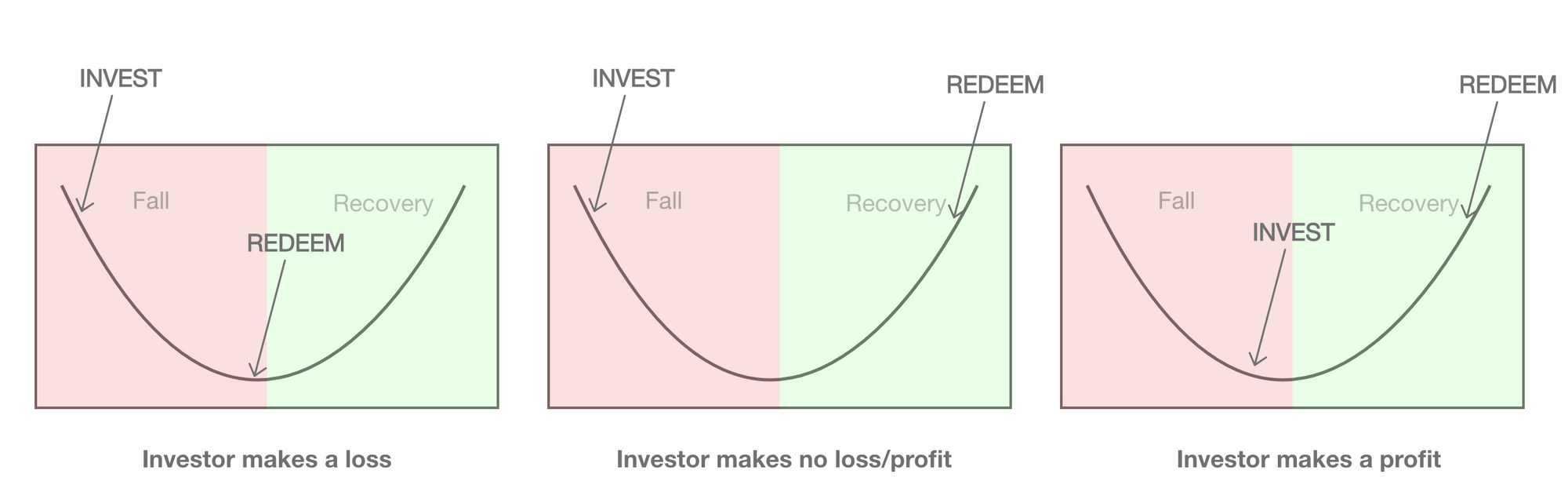

Investors have portfolios that are well planned as per their financial goals and requirements. Rest assured that our team of well qualified advisors are closely monitoring your investments and will be providing timely advice as and when necessary. Your investment plan already factors in the market valuations, market risk and your investment duration. Panicking and exiting the plan can cause a loss that is not only significant but also permanent.

2. Invest more if you have spare funds

Given that the prices of multiple funds have fallen steeply, it is a good opportunity for long term investors to purchase at a low cost. Many good funds have fallen as much as 30% which means that buying now will result in 40% more units! A good number of our investors have debt heavy portfolios which we are working on actively moving to equity over the coming weeks & months.

3. Contact your advisor in case of questions

Time and again, google and media have proven to be amongst the worst financial advisors. And this is valid even more so in this situation. If you have any questions or worries, your financial advisors are just a message or call away. We would be happy to explain the situation and assist you with the right action plan. Our next set of quarterly & half yearly portfolio reviews are due from April as well, for which we will be proactively contacting you to guide.

Don'ts

- Don't panic and hit the redeem button

If your financial goal is more than few years away, you need not worry and just stick to the investment plan. If your goal is less than a year or two away, then you should not have invested in equity markets in the first place - in which case the prudent option would be to redeem and exit.

2. Avoid checking your investment dashboard/AssetPlus app

The best of our investors created massive wealth in the 2000 - 2015 period when there were no apps to track your investments regularly and investors did not take irrational decisions. This is one of the few times where technology is a huge disadvantage since investors tend to check portfolios on a regular basis. Please keep in mind that your financial goals are years away and will not be affected by weekly fluctuations happening now. It is sufficient to track your investments once every 3/4 months.

3. Avoid unnecessary noise created by media

Media companies make money when the news is exaggerated and eye-catching. Viewers are not keen on listening to boring updates on coronavirus. It is essential to track the environment and adopt healthy habits to tackle the virus, but it is absolutely not required to check the status of your investments in connection with the virus unless you are a stock trader.

Conclusion

Although the media seems to be working overtime to create noise and spread rumours, it is evident that the fall in the markets is due to the coronavirus. Based on inputs from various sources, the virus is spreading across countries and the peak of the outbreak might or might not be around the corner. The positive news is that China has reported a steady decline in new cases of the virus, and about 60% of the businesses have re opened and are looking to get back on track, which leads us to believe that the outbreak can be optimistically contained within 2-3 months.

Stick to your investment plan, don't take decisions you will regret later and work towards achieving your financial goals. If you still have concerns, your advisors are just a phone call away. Happy investing!