Silver, one of the oldest known commodities in all of humankind is often viewed as just a shiny metal used for jewelry or tableware, but in reality, has tremendous other utility value, which makes it one of the most sought after metals in the world!

Silver as a raw material:

The shiny metal is consumed in a systematic and a large scale in various industries. It is quite indispensable, without which a lot of what we use on a day to day basis would cease to exist. Following are the major sectors/areas where Silver gets maximum traction:

- Electronics - Our television screens would be blank and switches would be ineffective had there not been silver. As a natural conductor of electricity, silver enables the easy functionality of numerous electronic devices.

- Passenger Vehicles and Engine Bearings - Almost everything in a modern day car would require silver to keep it functioning. From basic starting of an engine to clicks of power windows and back trunks, silver coated contacts plays the key role. Plus, certain vehicles like Flights/Helicopters require stronger ball bearings, which is wholly supported by silver.

- Solar Technology and Batteries - Conversion of light into electricity is facilitated by Photovoltaic cells, commonly known as Solar cells. Powdered silver is used in these cells to make effective conversion possible. The electricity generated is either used immediately or stored in the form of batteries. It is estimated that an average commercial solar panel uses around 20 grams of silver per unit.

- Fusing of various metal pieces - Electrical wires are easily fused with application of heat with different metal pieces like ducts, faucets, pipes etc. But little do we know that all these would hold strong only if Silver is used.

- Healthcare and Water Purification - Silver is known for killing germs and has been used widely in getting rid of harmful bacteria, hence finding an important place in medicines and cleansing of water.

Silver as an Investment Portfolio Component:

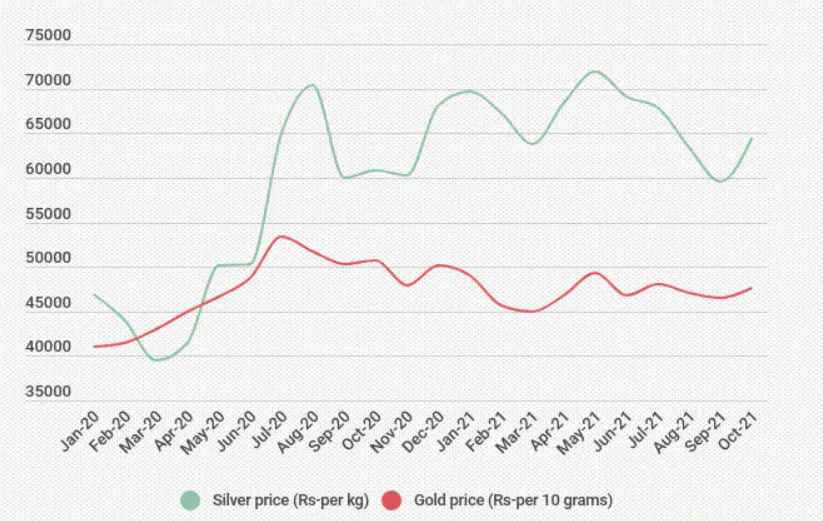

Gold is popularly used as a hedge against inflation and uncertainties across the world. On most of the occasions, when an Asset Class like Equity starts showing signs of dips or a downward trend, the bright yellow metal's value starts increasing. In this context, Silver too has a similar nature to Gold, but it is highly sensitive and comparatively has lesser stability than Gold, as Gold is considered as a safe haven while Silver relies a lot more on Industrial demand.

On the upswing, Silver outperforms Gold but at the same time when there is a fall, Silver takes a bigger hit. In the last two years, when the Global Pandemic Coronavirus wrecked havoc, Equity Markets all over the world took sizeable hits. Gold and Silver where the very few investment asset classes which not only held fort but also gave solid double digit returns. Silver stacked close to 46%, which was around 12% higher than that of Gold. But at the same time, Silver dropped faster and lost more value than Gold in the last 18 months.

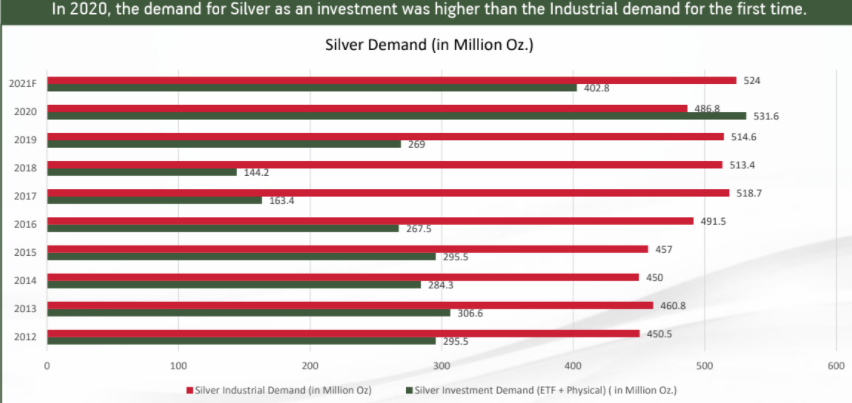

Due to all the positive aspects of Silver and an increased push towards a greener economy, the demand for Silver as an investment is galloping at a record pace.

What is a Silver Mutual Fund?

Silver Mutual Fund uses a Fund-of-Fund(FoF) strategy, wherein, the fund invests in its underlying Exchange Traded Fund(ETF). The ETF invests mainly in physical silver and silver related instruments. The price movement is directly related to the domestic price of Silver.

At the time of redemption, taxation is as follows:

- If units are sold within 3 years of date of purchase, Short term capital gains tax is applicable as per the marginal tax slab of the investor.

- If units are sold after 3 years of date of purchase, Long term capital gains tax is applicable at the rate of 20%+Indexation benefits.

Why should you opt for the Mutual Funds route instead of Physical Silver?

- High Liquidity - Ease of converting your investments into money

- Safety - Backed by Mutual Fund houses which are further governed by SEBI

- Making Charges and Wastages - Absolutely none which further helps in getting higher returns

- Storage - No issues like storage, thereby reducing the costs involved

- Amount - Can invest by starting with just 100 rupees and subsequent investments can be made anytime, amount as low as 1 rupee!

- Purity - Boasts a near perfect 99.9% levels

- SIP - Helps in averaging the costs as Systematic Investment Plan(SIP) captures the ups and downs of varying values of Silver

- Low Correlation with Equity: Helps in balancing the overall portfolio risk

Suitability of Silver Mutual Funds:

- Investors who are comfortable with high levels of volatility.

- A cost effective/better returns alternative to physical silver.

- Can be used as a tactical bet to make use of extreme fluctuations.

- In an ideal portfolio, Silver should be at a maximum of 5% of the entire allocation or half of Gold's allocation.

This is the first time a Silver Mutual Fund is being launched in India. Silver is here to stay and has its pros and cons. Investors must read the scheme documents fully before investing and/or consult a financial planner to make informed decisions.

NFOs which are currently open for subscription:

- Aditya Birla Sun Life Silver ETF FoF (13th January - 27th January)

- ICICI Prudential Silver ETF FoF (13th January - 27th January)