"Should I go for SIP or Lumpsum ?" is one of the burning questions among investors in the mutual funds industry.

A systematic Investment Plan is a method through which one can invest into a mutual fund scheme at regular intervals (daily, weekly, monthly, quarterly, half-yearly, yearly, etc.) over a period of time whereas through lumpsum one invests their money in a scheme in one go.

The frequency of investment is one of the elementary differences between SIPs and Lumpsums. However, this one factor can have a huge impact on your returns based on the market conditions which have been detailed in the below article.

Main Factors to consider before choosing between SIP and Lumpsum

- FREQUENCY OF INCOME - If you are running a business or a freelancer or have a career that offers infrequent cash flow, you could choose a lumpsum investment. On the other hand, a salaried employee trying to inculcate a savings habit can go for SIPs.

Investors with irregular cash flows still wanting to take advantage of rupee cost averaging can opt for STPs (Systematic Transfer Plan).

Rupee Cost-Averaging - In this approach, we invest a fixed amount of money at regular intervals regardless of the market conditions which ensures that we buy more units when the markets are low and lesser units when the markets are high.

Systematic Transfer Plan - STPs allow you to periodically switch/transfer a fixed amount of money from one mutual fund scheme to another at pre-defined intervals.

2. MARKET TIMING - A lumpsum investment might be able to generate higher returns during bearish (declining market) times. However, if we are unable to identify and time market cycles, SIPs would help us to distribute risks.

Performance Comparison

Now, let us have a comparison between returns earned on SIPs and Lumpsums over the past few years.

The above chart shows the comparison of lumpsum and SIP investments over the time horizon of the past 3, 5, and 10 years. As we can see, SIPs have generated greater returns over all the three-time horizons and the difference in returns has been over 8%, 1.75%, and 1% respectively in 3, 5, and 10 years. It is pertinent to note that the advantage of SIPs over lumpsum in the short-term horizons has been massive compared to the long-term horizons.

When do SIPs outperform Lumpsums?

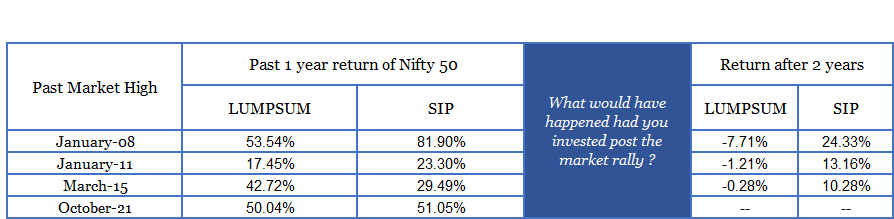

While we are not predicting a huge market crash or bearish event, it is important to note that markets have rallied significantly and some healthy correction might be underway. We have listed some past market peaks and what would have happened had investors entered with lumpsums and SIPs at such times.

Each time investors had witnessed healthy short-term returns and invested during such market peaks, their returns would have been negative for the next 2 years in terms of lumpsum whereas the returns remained positive in terms of SIP.

We witnessed a similar peak in Oct 2021, the past data shows that a market correction or bearish movement might be underway. After such high rallies, the returns generated from SIPs seem to be more sustained and positive when compared to lumpsums.

The Verdict

It is evident that SIPs have outperformed lumpsums in terms of returns in different time horizons, proving to be a feasible and high-return generating investment option due to the cost averaging benefit despite the minimal capital invested initially. So, when one is not sure between going for a SIP or lumpsum, SIPs would be a prudent choice as it seems to have sustained even during bearish market times.

However, we are not suggesting one shouldn't opt for lumpsum if they are looking for better returns. But market timing plays a pivotal role in lumpsums. If lumpsums cannot be timed perfectly, one might not accrue huge returns or might even suffer a loss. In that case, we would suggest opting for STPs into desired funds instead of direct one-time lumpsums to avail of the benefits of rupee cost averaging.

If you would like to know more about the suitable investment approach that would align with your goals, get in touch with our financial advisors.