Small-cap mutual funds, more often known for their high risk and extreme levels of volatility, deliver profoundly high returns when invested for a longer time frame. They may be small companies in market capitalization, but performance is extra large!

What is a Small-cap mutual fund?

A fund with a minimum of 65% of its total investments in stocks that are part of the Nifty Smallcap 250 Index is known as a small-cap mutual fund. As per SEBI categorization, there are 250 stocks in the Indian stock market that are classified as small-caps based on their market capitalization, and for a small-cap mutual fund, at least 65% of their overall portfolio must be from these 250 stocks, while the remaining 35% can be from small-cap or any other market cap or even any other asset class like REIT(Maximum 10%) or Debt instruments.

How does a Small-cap mutual fund behave?

The nature of small-cap as a category is its deep fluctuations. Be it an upside or a downside, small-caps tend to have the sharpest movements when compared to mid-cap and large-cap peers.

Small-caps in most situations follows the overall economy’s trajectory. When there are positive sentiments and an economic boom with flourishing business activities, small-cap funds significantly generate humungous returns. At the same time, when there are massive negative instances affecting the market or when the tide of the economy starts to turn pessimistic, small-cap funds start to sink first. A typical small-cap mutual fund is prone to more risk as it may stay in the negative territory and decline rapidly but also more rewarding as it flies higher than the rest in the long run.

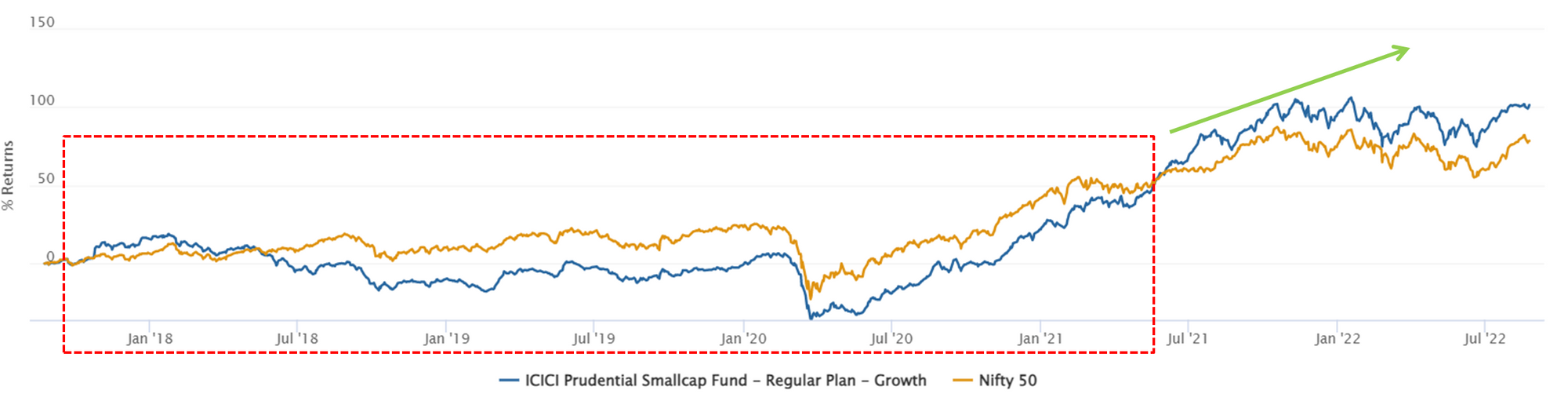

From the above image, two key inferences can be drawn. The red box conveys how an active small-cap fund(ICICI Smallcap), denoted by the blue line, has nearly underperformed the flagship large-cap Index(Nifty 50), represented by the yellow line, for around three years, starting from May 2018 till May 2021. The green arrow signifies the strong outperformance beginning from June 2021 till the present. So this clearly indicates that Small-cap tends to react significantly to market movements, be it a crash during May 2018/ March 2020 or the upside recovery in 2020-21.

Some of the famous small-cap mutual funds:

- ICICI Smallcap (Rejuvenated performer)

- Axis Smallcap (Long-term performer)

- Canara Robeco Smallcap (Rising Star)

Features of Small-cap mutual fund:

- Highly volatile when compared to other main categories of equity mutual funds.

- Involves very high risk but matches it with very high returns in the long run.

- Susceptible to severe drawdowns and crashes, especially in the short term.

- Possibilities of prolonged periods of negative returns.

- Significant Alpha-generator and consistently outperforms the index.

- Invests in companies that have the potential to become large-caps. E.g., Bajaj Finance

- Front-runners of future growth drivers of the country.

Suitability of Small-cap mutual fund:

- Investors who are seeking long-term capital appreciation.

- Well suited for an investment time horizon of more than seven years.

- Investors who are seeking higher returns than other equity categories.

- Investors who possess a high-risk appetite with greater risk capacity.

- Fulfilling long-term goals like Retirement, Children’s education, Wealth creation, etc.

- Investors who can understand different phases of market cycles.

- Investors who are comfortable with very high levels of volatility.

It is safe to say that small-cap mutual funds are ideal for long-term wealth creation. However, at the same time, one must understand their nature and the risks associated with them before investing. Get in touch with your financial expert to know more!