Aditya Birla Mutual Fund has launched the Aditya Birla Sun Life Nifty SDL Plus PSU Bond Sep 2026 60:40 Index Fund, which is open for subscription from September 15th, 2021 to September 23rd, 2021.

Investment Objective: The investment objective of the scheme is to track the Nifty SDL Plus PSU Bond Sep 2026 60:40 Index by investing in PSU Bonds and SDLs, maturing on or before September 2026, subject to tracking errors.

Benchmark: Nifty SDL Plus PSU Bond Sep 2026 60:40 Index

Fund Philosophy

It seeks to measure the performance of portfolio that consists of SDLs & AAA rated PSU bonds that mature between Sept 30, 2025 to Sept 30, 2026 & constitute Nifty SDL Plus PSU Bond Sep 2026 60:40 Index

To understand this fund, we must first understand the underlying index it tracks

How is the index constructed?

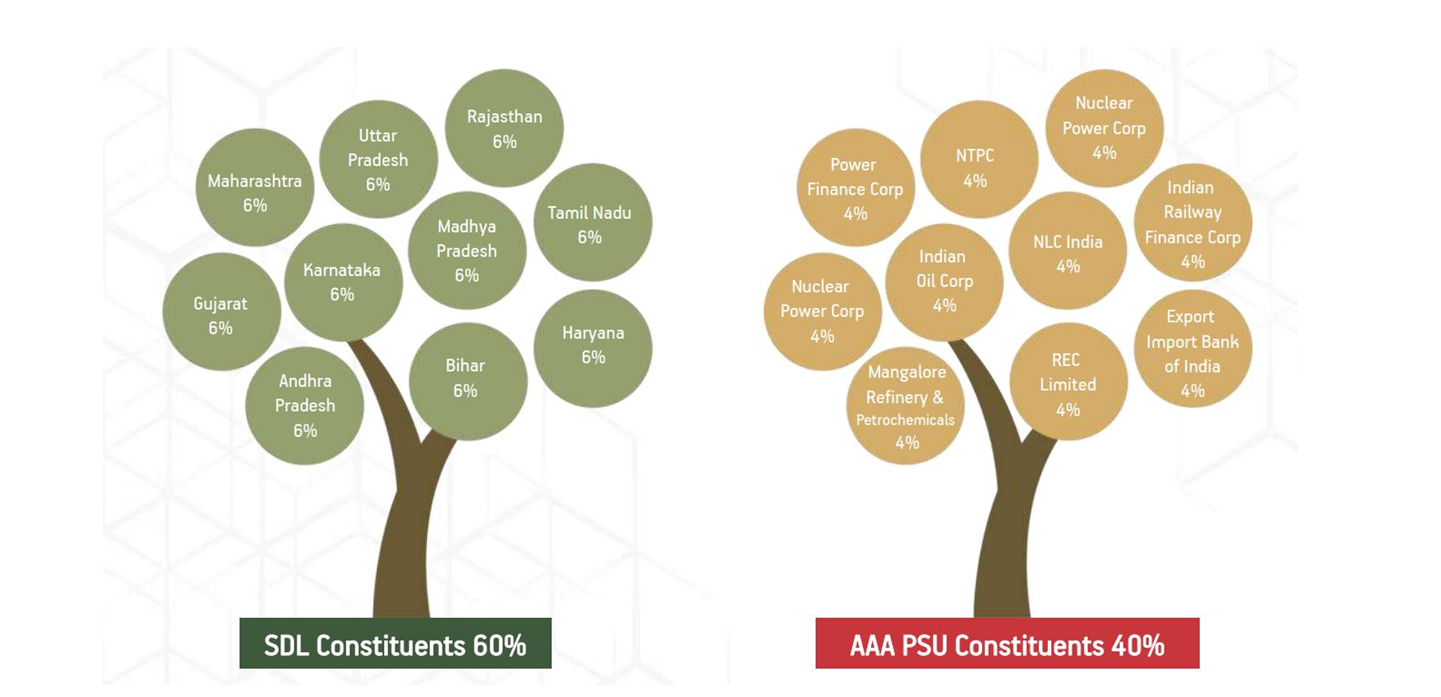

The fund constitutes two components with equal weighted constituents:

➢ SDL component (60%): Top 10 states/UTs ranked based on composite liquidity score.

➢ PSU Bonds component (40%): Top 11 AAA rated PSU ranked based on composite liquidity score.

➢ Rebalanced on a quarterly basis.

➢ The coupons will be reinvested in the proportion of existing weights

Portfolio Constituents

Why should you invest?

- Target Maturity approach – ability to customize your investment as per your goals

- Tax efficient due to benefit of 5- year indexation

- Credit risk mitigated as part of design

- No Duration risk at time of maturity

- Roll down strategy - apt in the current interest rate environment

Target maturity funds are suitable for conservative long-term debt investors. With current interest rates being at all-time lows, they offer better returns than FDs of the same tenure and the additional tax benefit.

It is of utmost importance that the fund should be discussed with your financial advisor and then ascertain whether it is suitable to invest. Always read the scheme documents fully before investing.