Recently, there has been a lot of buzz around balanced advantage funds. In August this year, SBI NFO hit new records after collecting Rs 14,500 crore in its Balanced Advantage Fund NFO. We decided to break down the category, understand its core features and see what all the hype is about.

Understanding balanced advantage funds

Balanced advantage and dynamic asset allocation funds hold both debt and equity positions in their portfolio and periodically rebalance the debt and equity levels based on various factors, prime being market valuations.

You might wonder if you even need a fund that holds debt and equity?

Why do we need asset allocation

Asset class winners keep rotating and no one asset class does well every year. Investments in only one asset class can give very skewed and one-sided returns in a given time frame. You can ensure more consistency and stability in returns year-on-year by allocating optimally between both asset classes.

How do you decide this optimal asset allocation though?

How rebalancing works

Usually a balanced advantage funds takes into account factors like valuations (P/E, P/B levels), interest rates and other macro indicators to determine if market valuations are on the higher or lower side.

Based on each fund’s proprietary model, they alter equity and debt levels – increasing equity when market valuations are low and decreasing equity when valuations are high.

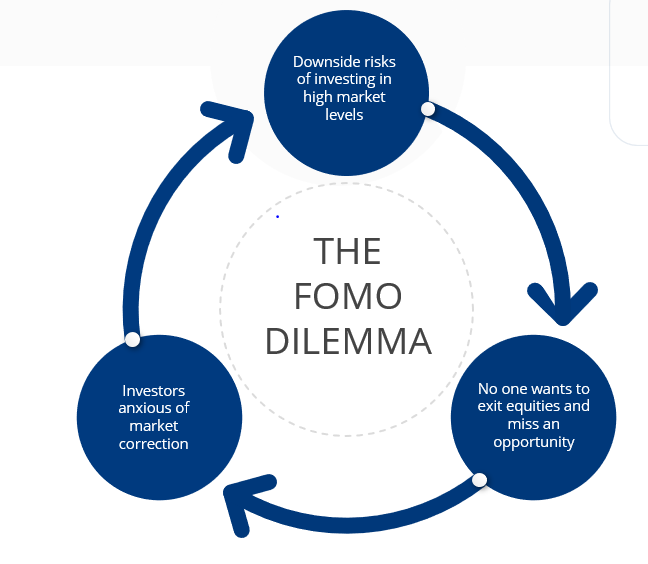

The FOMO dilemma

Everyone wants to buy low and sell high. However, data shows the opposite happening. Retail investments are at peak during market tops and bottom out during market crashes. The primary reason is entering late in a bull market after watching your peers make money or due to increasing media noise.

These investors enter equities with heavy lumpsums at such market peaks and experience negative returns and swear to never touch equities again. So, what is the alternate?

While long-term SIPs must run as is, for new lumpsum investments, balanced advantage funds are the ideal investments to enter during such market peaks as they can give equity exposure with low volatility and drawdowns.

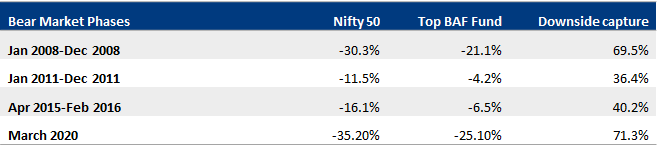

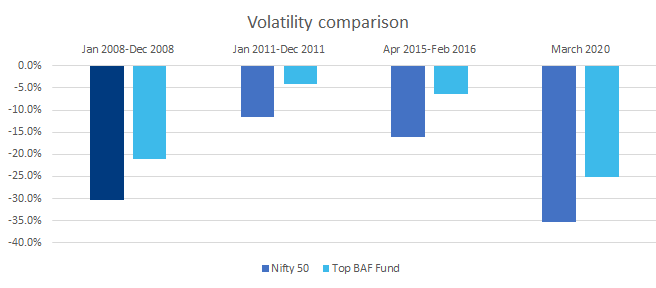

The proof of low volatility

We did some deep dive into the data to confirm on the low volatility promise. We considered returns of the top BAF fund in the market with a long track record vs Nifty 50. As we are measuring volatility, we took time periods when markets were going through bearish phases. Here is what we found -

It is clear that during bear markets or market crashes, balanced advantage funds have lower drawdowns than the benchmark. On an average, the top BAF in the market is 45% less volatile than the index during a market crash.

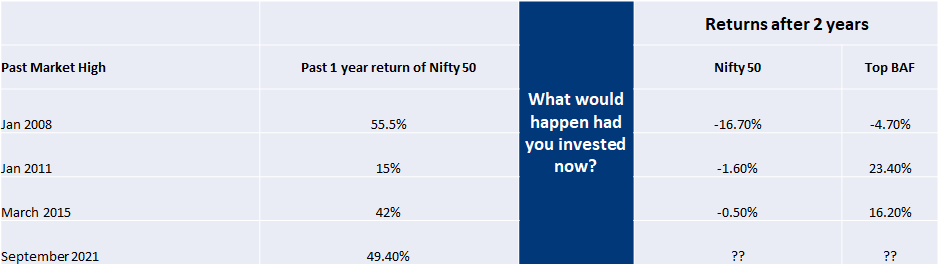

What is the best time to enter these funds

While we are not predicting a huge market crash or bearish event, it is important to note that markets have rallied significantly and some healthy correction might be underway. We have listed below past market peaks and what would have happened had investors entered with lumpsums at such times.

Each time investors saw healthy past short-term returns and invested, they would have seen negative returns for the next 2 years atleast. However, the same lumpsum invested in a balanced advantage fund could put you in the green way sooner.

Why would you not just invest in debt and equity funds separately?

You might think you can manage your asset allocation by just investing in debt and equity funds separately. However there are various challenges that come with manually rebalancing between debt and equity funds -

Exit load penalties - While debt funds are usually exit load free, most equity funds have a 1% exit load for the first year. Switching from equity to debt will dilute investor's returns because of the exit penalties.

Tax implications - Debt funds are taxed at your tax slab in the short-term and can go as high as 30%. A balanced advantage fund is taxed as a equity fund at all times (15% in the short term, 10% in the long term), making it a more tax efficient option.

Moreover each time you redeem a debt or equity fund, you have to bear the tax liability. Internal rebalancing in a balanced advantage fund has no tax implications for the investor.

Switching costs - Each transaction in mutual fund bears a nominal STT charge. While this is a negligible amount, excessive switching can lead to paying the same fee multiple times.

In conclusion, balanced advantage funds pose as an ideal cost and tax efficient investment option for investors are anxious about investing lumpsums at such market peaks and want equity exposure with low volatility.

You can have a look and download our factsheets outlining the key takeaways and our top fund recommendations in the category -

https://partnerbeta.assetplus.in/home/resources/marketing