DSP AMC is launching a NFO, which is set to open for subscription from Jan 24th, 2022 and closes on Feb 7th, 2022.

Investment Objective: To generate wealth over the long term, suitable for investors having a very high risk appetite who are comfortable with very high levels of volatility.

Investment Strategy: The fund emphasizes on the Innovation Theme and invests through Fund-of-Fund(FOF). FOF is a strategy where a scheme decides to invest in another existing mutual fund scheme(s) and/or Exchange Traded Funds(ETF) instead of investing in stocks directly. The fund aims to generate returns by investing in companies present all over the world whose primary focus is on innovating and disrupting the existing field.

Fund Manager: Jay Kothari

Benchmark: MSCI All Country World Index TRI

Minimum Lumpsum Investment Amount: Rs 500

Minimum SIP Investment Amount: Rs 500

Fund Management Process:

- The fund management style is a combination of active and passive(70:30) as it invests in actively managed international mutual funds as well as ETFs.

- The fund consists of 6 main underlying components, out of which 4 are active and 2 are passively managed. It follows a minimum 15% weightage to each fund a maximum of 50% to any given fund. The underlying components along with its style of investing and weightage are as follows:

- Morgan Stanley US Insight Fund(Active) - 15%

- BGF World Technology(Active) - 20%

- Nikko AM ARK Disruptive Innovation Fund(Active) - 15%

- iShares NASDAQ 100 UCITs ETF(Passive) - 15%

- Bluebox Global Technology Fund(Active) - 20%

- iShares Semiconductor ETF(Passive) - 15%

3. Monitored on a half yearly basis which includes thorough screening of its underlying components based on performance, investment strategy, portfolio etc.

4. Rebalanced every year based on market value and if necessary, existing components can be replaced by newer ones.

Opportunity:

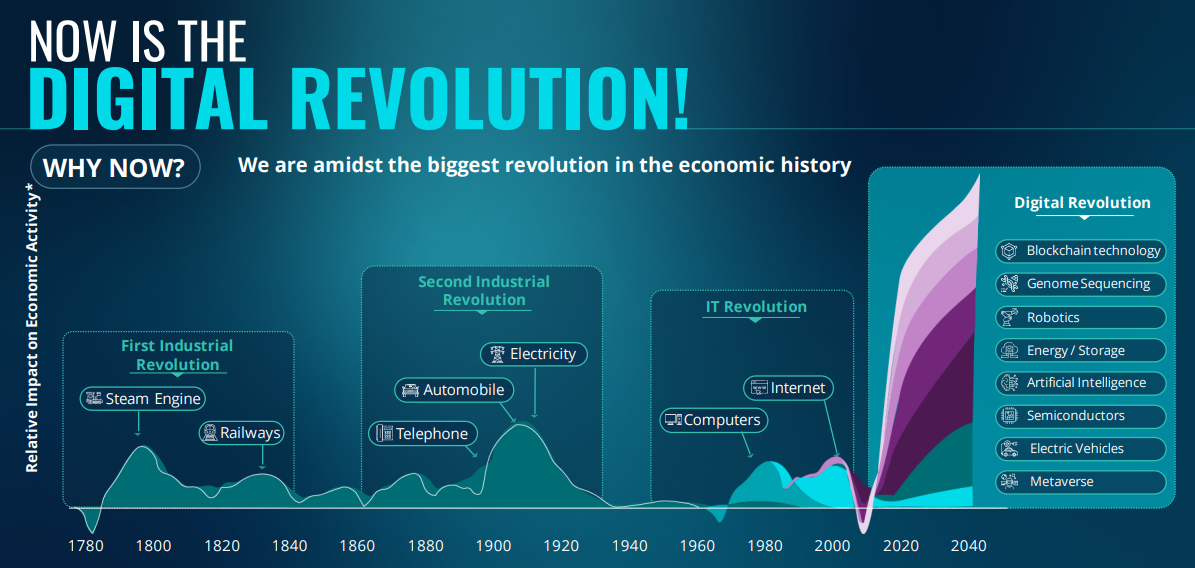

The world as such has been evolving at a rapid pace and innovation is the key driver to every new phenomenon. Innovation has not only made our life simpler in our day to day activities but also paved the way to remarkable solutions in core essential aspects like Healthcare, Education and Finance. The story of innovation is something which is evergreen, and more so in the modern world of technology.

Some of themes which fall under this category are:

- Semiconductors and Electric Vehicles(EVs)

- Internet and allied technologies(Metaverse)

- Bio-Technology and Healthcare solutions

- E-Commerce sites

- Fintech companies

The growth potential for investing in these themes has no limits, as the final output of every act of innovation has added more value to humankind in immeasurable ways.

Based on our analysis, we have observed the following pros and cons:

Pros:

- Combination of Active+Passive style investing

- Focuses on companies which are global leaders in disruption and innovation

- Opportunity to take part in International Markets with no restriction to any specific geography

- Market Cap and Sector Agnostic

- Taxation is a replica of Debt Mutual Funds, providing Indexation benefit for a holding period of more than 3 years

Cons:

- In the current scenario, there is no exposure to Indian Markets

- Extremely high levels of volatility

- Relatively new theme of investing with no clear benchmarking

- Emerging markets like India pose a threat by having the potential to deliver superior returns in the longer run with increased opportunities through advancements and innovation

- Currency risk (The Dollar-Rupee Value keeps fluctuating and can affect the overall investment amount)

This fund has a unique combination of an Active+Passive fund management but focuses more on the theme of innovation through investments in global markets. Investors who would like to get an exposure to innovation oriented international companies can consider investing in this fund as it is cost efficient and easily accessible. But at the same time, risk involved is comparatively higher and the product as such is slightly complex and is susceptible to sharp levels of fluctuations.

It is of utmost importance that the fund should be discussed with your financial advisor and then ascertain whether it is suitable to invest. Always read the scheme documents fully before investing.