Mirae AMC is launching a NFO, which is set to open for subscription from Feb 24th, 2021 and closes on March 9th, 2021.

Investment Objective: To generate better returns than a fixed deposit/corporate deposit in the medium to long term, suitable for investors having a moderate risk appetite who are comfortable with mild short term volatility.

Investment Strategy: The fund has a specified allocation to fixed income instruments with intricate filters to enhance credit quality and liquidity. The fund is mandated to have at least 80% of its investments in debt instruments having a rating of AA+. It is further supplemented by having exposure to Government Securities(G-Secs) and Treasury Bills(T-Bills). The focus is to generate higher returns than an ultra short/low duration debt fund by giving higher exposure to longer duration securities of bonds backed by corporates.

Fund Manager: Mahendra Jajoo

Benchmark: Nifty Corporate Bond Index

Recommended Time Horizon: 3 - 5 years

Minimum Lumpsum Investment Amount: Rs 5,000

Minimum SIP Investment Amount: Rs 1,000

Suitability:

- Prime alternative to fixed deposits.

- Investors having low risk capacity.

- Investors who are nearing retirement or have already retired.

- Investors who are looking to preserve their wealth.

- Investors looking to park their money for short term goals (3-5 years)

Opportunity:

The economy post lockdown has recovered faster than expected and with that being said, corporates with solid track record will benefit as their bonds are of very good quality and have higher prospects of being rated in the top zone. This not only provides more safety but also maintains healthy levels of liquidity. Risk of default is extremely low in this bucket of Investments as instruments chosen are of minimum of CRISIL AA+

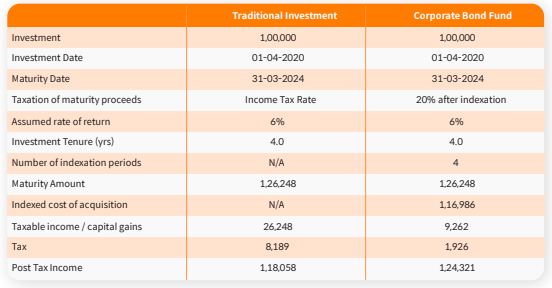

Also, if one is looking to park their capital for a minimum of three years with the expectations of protecting their wealth similar to a fixed deposit, then corporate bond funds are a clear winner as they not only provide better returns but also give remarkable tax benefits in the form of Indexation. Indexation helps in increasing the original cost of the debt fund by adjusting it to prevalent inflation, thereby reducing the overall gains while selling, resulting in lower taxes on the profits made.

Fund Management Process:

- Selection criteria is purely from the universe of fixed income instruments.

- The fund has positioned itself to have an active management at all times while choosing instruments.

- Investments will be finalized based on the following:

- Credit Rating (Preferably AAA, but focusing on at least having AA+ and above)

- G-Secs will be given priority over SGL

- High Liquidity

- High Safety

4. Modified Duration of fund is estimated to be kept at 2-5 years

5. Rebalancing of the portfolio will be done based on the interest rate cycle.

Based on our analysis, we have observed the following pros and cons

Pros:

- Actively managed portfolio with a clear fund philosophy

- No lock-in period

- Scope for higher returns when compared to other options like Fixed Deposits

- No exit load

- Tremendously tax efficient over a period of more than 3 years

Cons:

- Quite sensitive to interest rate movements

- Volatility in the short term can be high

Debt Mutual Funds as a product are generally used for wealth preservation with an expectation of having slightly better returns than savings bank/fixed deposit. Corporate Bond Funds as a category tries to champion this philosophy, with liquidity and safety as priority, but at the same time, exposes itself to moderate volatility caused by interest rate fluctuations.

It is good to diversify by allocating some amount of portfolio into this fund for moderate returns and capital protection but investors should make sure there are substantial investments in Equity Mutual Funds as per their risk appetite, as they have a greater capacity of delivering inflation beating returns in the longer run. It is of utmost importance that the fund should be discussed with your financial advisor and then ascertain whether it is suitable to invest. Always read the scheme documents fully before investing.