UTI AMC is launching a NFO, which is set to open for subscription from Feb 18th, 2021 and closes on March 4th, 2021.

Investment Objective: To generate wealth over the long term, suitable for investors having a very high risk appetite who are comfortable with high levels of volatility.

Investment Strategy: The fund emphasizes on select 30 stocks from the first 200 listed stocks of Nifty(1-200) which have high normalized momentum scores. The fund will invest based on trends exhibited by the stocks, determined by normalized momentum scores which is based on 6 month and 12 month price return, adjusted for its daily price return volatility. The focus is to create returns which can outperform the the traditional benchmark by riding on the momentum wave. In simple terms, the portfolio is built on the concept of stocks which outperform in the short term may continue to outperform for a longer period, and vice versa.

Fund Manager: Sharwan Kumar Goyal

Benchmark: Nifty200 Momentum 30 TRI

Minimum Lumpsum Investment Amount: Rs 5,000

Minimum SIP Investment Amount: Rs 500

Fund Management Process:

- The fund is passively managed and will directly replicate the Nifty200 Momentum 30 Index.

2. Proportion of each stock in this index is based on product of free float market capitalization and Normalized Momentum Scores.

3. Stock weights are capped at lower of 5% or 5 times the weight of the stock in the index constructed purely on free float market capitalization.

4. To reduce the overall portfolio turnover, a buffer based on Normalized Momentum Score Ranks is applied.

5. Any changes in the benchmark will automatically reflect in the Index fund as well.

6. The fund is rebalanced on a semi-annual basis.

Opportunity:

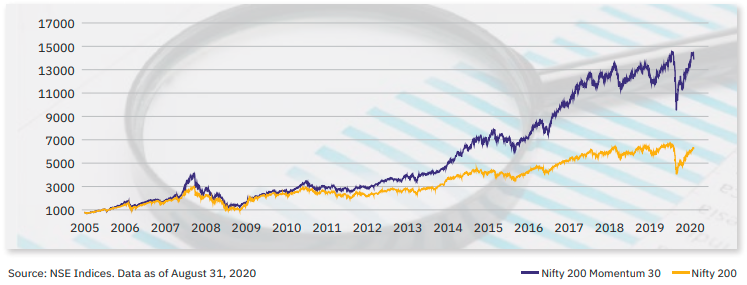

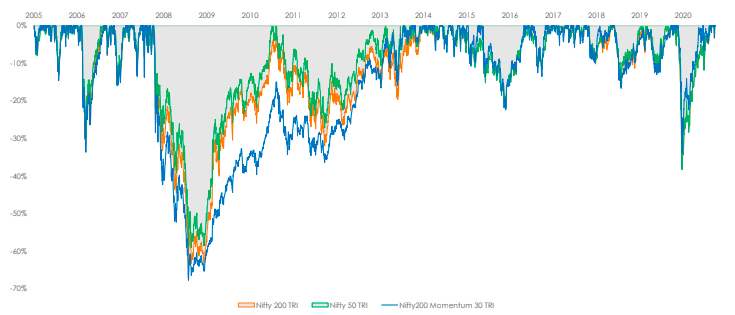

Nifty200 Momentum 30 is a unique index. The element of Momentum drives the stocks towards extreme levels of outperformance but at a significantly higher level of risk. From returns point of view, in the long run and since its inception, this index has clearly beaten its parent index, which is Nifty 200.

Since this Index constitutes only 30 stocks, the investing style is highly focused and risk is concentrated when compared to Nifty 200. This can lead to massive corrections from its peak and at the same time, bounce back at a faster pace.

Based on our analysis, we have observed the following pros and cons

Pros:

- No Fund Manager Bias or Human Intervention.

- Focuses on companies which have already outperformed its peers.

- No Exit Load.

- Aggressive rotation among sectors as it is momentum driven.

- Low Cost as it is Index Based.

Cons:

- Limited to just 30 stocks.

- No quantitative metrics or fundamental analysis is used while picking stocks.

- Can lead to overweight in sectors which have already reached its peak.

- Cannot take active calls like holding cash in a portfolio.

- Focuses purely on price levels of stock, thereby ignoring several qualitative factors.

This fund does not have an active fund management but focuses more on Momentum story of 30 stocks from Nifty 200 TRI. This style of price based investing has tremendous potential to ride on the winning wave, but at the same time, could be the first to fall when the market turns red.

Investors can consider allocating a small amount of their portfolio towards this fund if they are comfortable with a concentrated approach powered by Momentum. It is of utmost importance that the fund should be discussed with your financial advisor and then ascertain whether it is suitable to invest. Always read the scheme documents fully before investing.