Kotak Mutual Fund is launching an NFO, which is open for subscription from July 8th, 2021 to July 22nd, 2021.

Investment Objective: The investment objective of the scheme is to provide capital appreciation by investing in an underlying fund of international equity and equity related instruments. The fund will invest in units of the underlying fund - Wellington Global Innovation Fund which seeks to invest in companies whose core focus is on disrupting industries through tech and innovation.

Benchmark: MSCI All Country World Index TRI

Fund Management Process:

- The fund will invest in companies that are drivers of innovation and trend that have low risk, high barrier to entry.

- The fund has a strong fundamental driven process to selecting stocks while taking growth factors and valuations into account.

- Keeping in line with the futuristic theme, the fund also applies ESG factors while selecting companies.

Portfolio Construction:

- The fund will have 40-70 stocks with not more than 10% in one stock at any point. The fund also has significant exposure to small and mid cap companies

- The fund will invest in companies across all market caps with a bias to growth stocks with low churn.

- The fund has no restrictions on any particular country or industry they can invest in. Currently 73% of the portfolio is in US stocks and around 14% is in emerging markets.

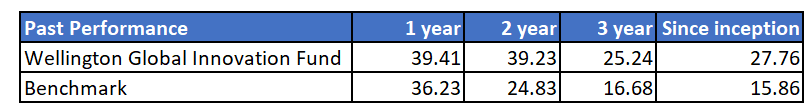

Backtested Returns:

Though the fund is launching for the first time in India, the underlying fund has been operational since 2017. Below are the past returns of the fund since inception:

Based on our analysis, we have observed the following pros and cons

Pros:

- High growth potential as the fund invests in emerging and futuristic themes that can offer high alpha

- Exposure to global markets and portfolio diversification.

- No restriction on market caps, country or industry. The ability to adjust the portfolio based on market valuations and economic forecasts of different categories, countries and sectors.

- Tech based and innovative companies are defensive in nature. They tend to perform across all economic cycles, boom or recession.

- Strong track record based on past returns.

Cons:

- Concentration towards tech stocks that have rallied significantly in the last 1 year and are currently highly valued.

- Higher than equity taxation. Fund of funds are taxed the same way as debt funds.

Over the last few years, majority of stock market gains have come from tech stocks and disruptive themes. While this may be a good long-term investment, with current market valuations on the higher side, investors must be cautious while investing high amounts. SIP's or STP's are recommended over lumpsum investments in such funds. A 10-20% allocation to global funds can be suitable for moderate to aggressive equity investors who are looking to stay invested over 5 years and wish to diversify their portfolio.

It is of utmost importance that the fund should be discussed with your financial advisor and then ascertain whether it is suitable to invest. Always read the scheme documents fully before investing.