On February 14, the nation witnessed a tragic event in the suicide bomb attack at Puwalma where 40 brave soldiers were killed, leaving the country mourning. On February 26, the IAF struck back to hit terrorist training camps in Balakot, Pakistan.

Many of our investors were concerned about their investments taking a hit in case the situation escalated. Do such military actions really impact one's Mutual Fund investments? Let us take a look at the past data.

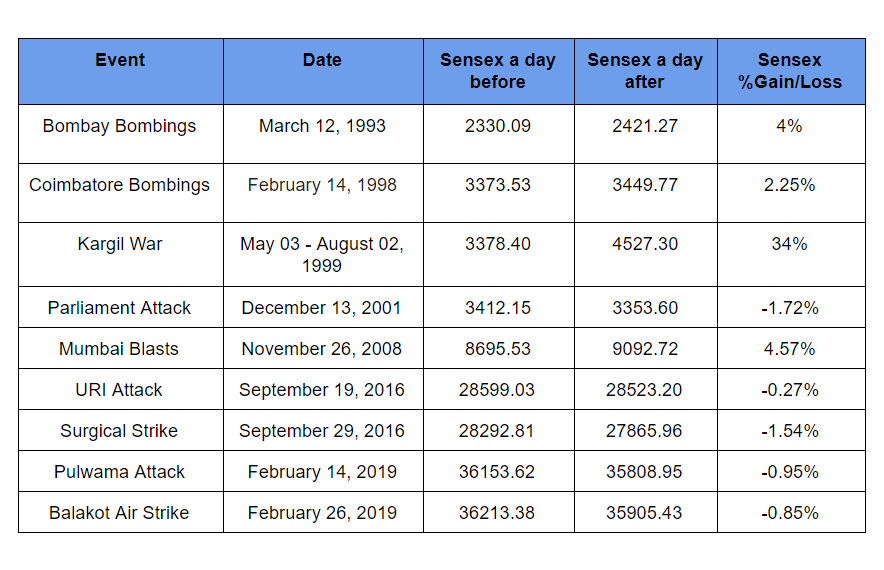

We compare how Sensex has previously reacted to various military events in India. To get a fair understanding of the knee-jerk reactions, we have looked at how markets reacted within a day of the event.

It is surprising that during the 3 month long Kargil war, the Sensex actually gained 33%. Even during the Mumbai attacks in 2008, the markets rallied by 400 points and showed a 4% gains in just a matter of days. Whereas in case of most other events the markets hardly reacted. The best conclusion we can derive from the above data is that there might be certain knee-jerk reactions when such events become known to the public but the markets eventually recover (They did so even after World War II!)

Such tensions within a nation is not new and long term investors should not be worried by such events. If your financial goals are more than 7 years away, it is best to continue investing and review your portfolio as per your plan.

Our favourite holding period is forever - Warren Buffett

If your goals are less than 7 years away and you are majorly invested in equities, then you have taken an unnecessary gamble and are too optimistic about your Equity Mutual Funds. We are yet to see an investor who has successfully created his retirement corpus in Mutual Funds due to luck!