Market Regulator SEBI has announced that pooling of funds and units by stockbrokers or clearing members should be discontinued for mutual fund transactions effective from July 1, 2022.

To understand the impact and the reason behind this move, it would be pertinent to first note the various channels through which the money flows from your bank account to the mutual fund house.

MUTUAL FUND INVESTMENT MODES

There are three major channels through which the fund usually flows:

(1) INVESTMENT DIRECTLY WITH THE AMCs

The direct investments with the AMCs usually flow when invested directly from their website or through their offline branches.

The direct investments made through the AMCs website might make it difficult for you to track, given that you invest in funds of several companies and the offline direct investments might be time-consuming.

(2) INVESTMENT THROUGH STOCK BROKER(s)/MFD(s)/IA(s) USING EXCHANGE PLATFORM

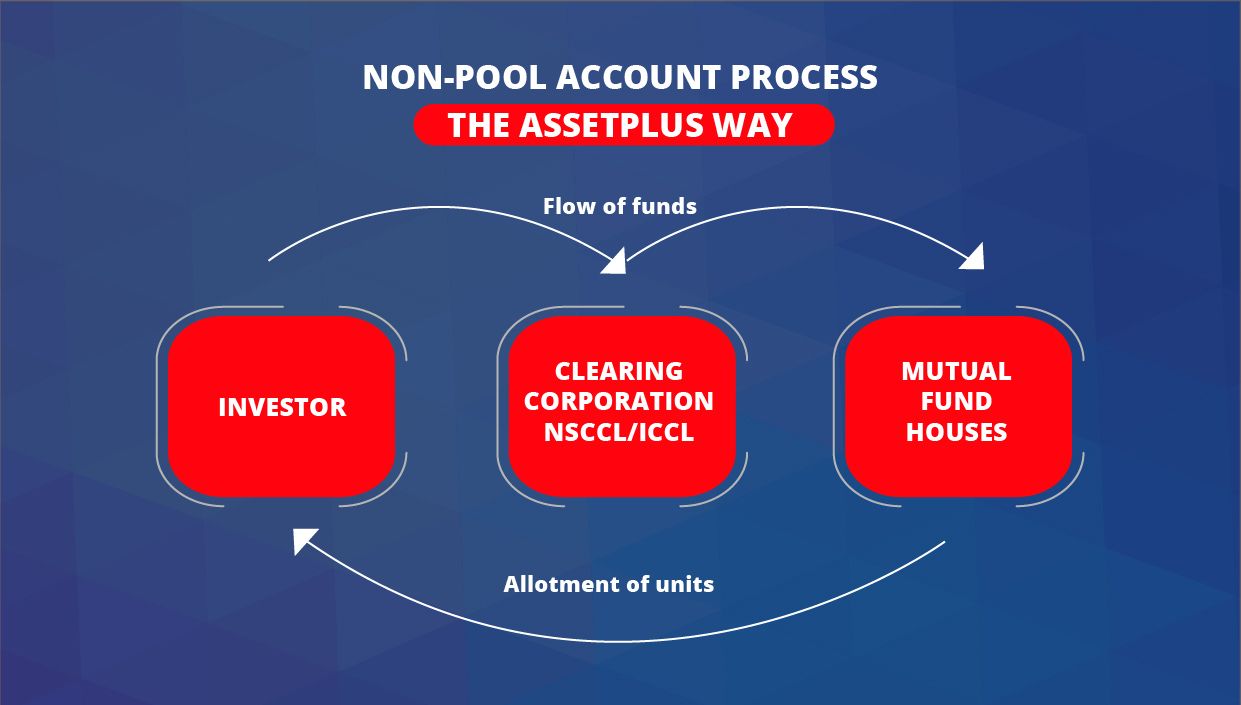

The investments made through these intermediaries using the exchange platform flow directly from the investor’s bank account to the clearing corporations (NSCCL/ICCL), then to the respective mutual fund house.

Clearing corporations are entities affiliated with a stock exchange whose primary objective is to oversee the handling of confirmation, settlement, and delivery of transactions.

There are two major clearing corporations in India – NSCCL and ICCL regulated by SEBI.

(3) INVESTMENT THROUGH STOCK BROKER(s)/MFD(s)/IA(s) OUTSIDE EXCHANGE PLATFORMS

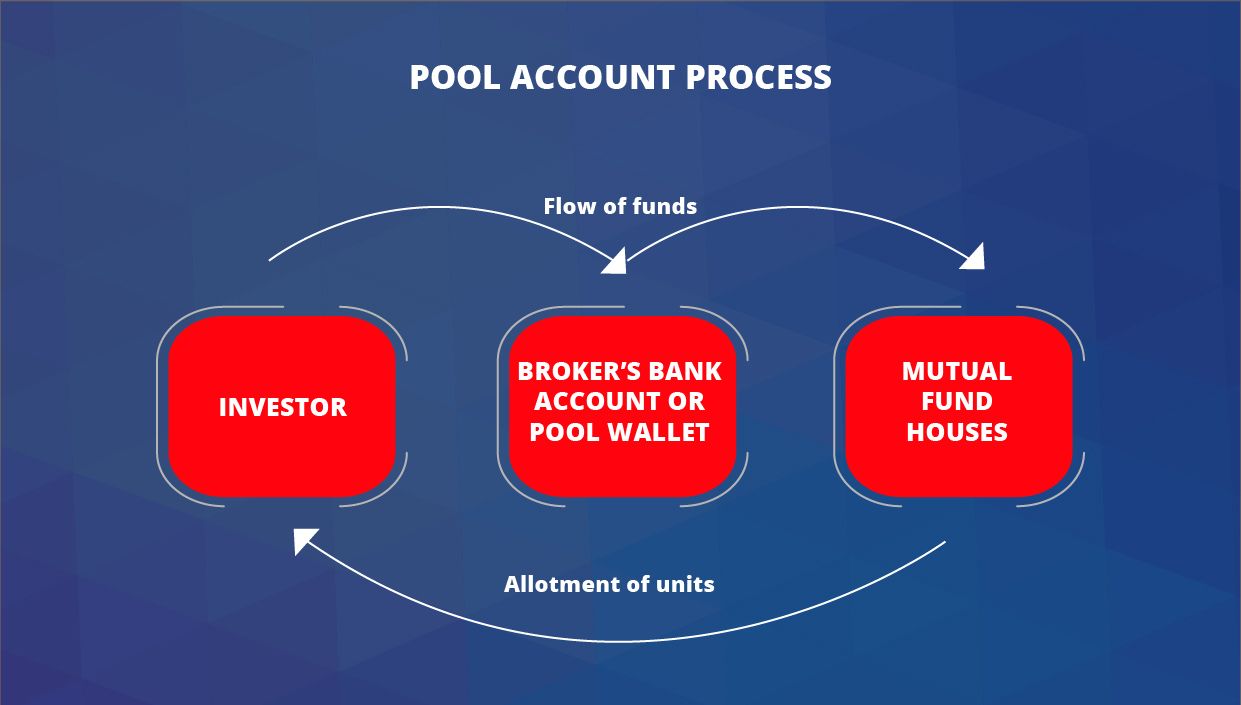

Here, the money flows first to the broker’s bank account or pool wallet, and then it is transferred to the mutual fund houses.

WHAT ARE POOL ACCOUNTS?

Pool accounts are money wallets held with your stockbrokers. The money in your wallet with the stockbroker could be used for all transactions through their platform. According to SEBI’s new circular, you will no longer be able to use that wallet balance for mutual fund transactions from July 1, 2022.

Pool accounts come into play when the investments are done outside exchange platforms where aggregator/brokerage platforms pool the investors’ funds in an escrow or nodal account and subsequently transfer them to the AMCs either per transaction or by lump-sum basis.

WHY WAS THE CIRCULAR ON DISCONTINUATION OF POOL ACCOUNTS ISSUED?

This was taken as a step to avoid mishandling of the funds by the brokerage firms and to protect investors’ interests.

In recent times, a renowned stock brokerage firm that was following the pool account process had fraudulently transferred their client’s securities to their own Demat account and had pledged securities held in that account with banks for loans. There have also been other minor cases reported where small brokers have misused clients' funds or tried to delay payments to AMCs to earn interest on this balance.

In light of these events, SEBI has brought in this ban on the use of pool accounts for mutual fund transactions and has directed AMCs to make sure that no mutual fund distributor, online platform, stockbroker, or investment advisor pools investors’ money in a bank account before transferring it to the fund house to ensure that the money does not get misused.

The capital markets regulator has also barred the launch of new mutual fund schemes until the pool account process is discontinued.

DOES THIS AFFECT ASSETPLUS INVESTORS?

The answer would be NO. Since its inception, AssetPlus has been facilitating mutual fund transactions through a clearing corporation (ICCL) which are transferred directly from the client’s bank account.

At AssetPlus, we have never taken an investor's money into a pool account or a wallet system. We ensure investors' money flows directly to the AMC through ICCL and hence have a 0% default rate.

To be on the safer side, we recommend never investing your money into a third-party account that is not regulated by SEBI.