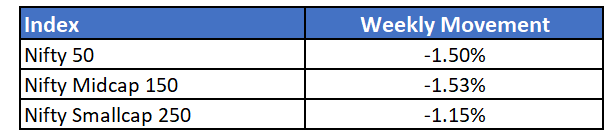

Despite it being a short week, markets faced volatility on the downside upon release of high inflation numbers for the month of March.

Indian inflation stood at 6.97% in March vs 6.05% in February. Both numbers are far higher than the inflation target set by RBI.

With the rise in inflation, rate hikes by RBI can be expected sooner than the anticipated end of year promise. There is likelihood of a rate hike in the September session. GDP projections for FY22-23 could also fall if inflation continued to be on the higher end

U.S inflation numbers for March 2022 also touched new multi-decadal highs at a staggering 8.4%. The US 10Y bond yields also soared to 2.8% on Thursday, a level last seen in 2018.

As a result, US markets also ended the week lower with the S&P 500 down 2.13% and the Nasdaq down 2.63%. The fall in tech stocks is majorly due to the high inflation numbers as investors tend to move away from highly priced growth stocks to more stable value stocks during times of high interest rates.

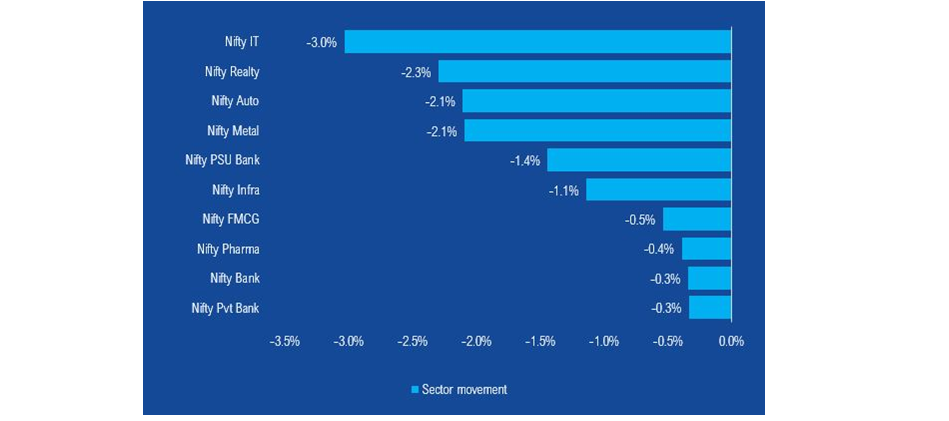

All major sectors ended the week in red. IT sector was the biggest loser for the second consecutive week following suit with the Nasdaq index.

No new NFOs are currently open