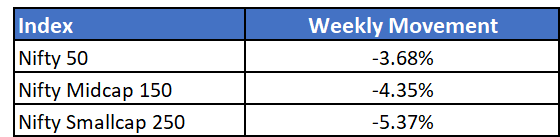

Markets experienced heavy downward movement in the week amid rate hikes and global pressures. Mid and smallcaps fell considerably higher in the week

Markets faced the worst single-week fall since May 2020

The key highlight during the week was Fed Monetary Policy Meet conducted between June 14-15. Key highlights of the meeting were:

- Fed hiked interest rates by 75 basis points

- The last time they did such a steep hike was in November 1994

- The benchmark rate is between 1.50 - 1.75% now

- Fed committed to returning U.S. inflation to 2%

The Fed hiked rates so aggressively since inflation wasn't cooling down. They have also said that the next hike could be 75 bps but in the future such large hikes would be uncommon.

U.S markets did not react severely to the news even though only a 50 bps hike was priced in. S&P 500 was down 4% while Nasdaq was down 1.5% during the week.

Domestic markets could face more downside pressure in the coming weeks.

Sectoral Movement

All major sectors ended the week in red. Metals and IT saw the most downside while consumer driven stocks like FMCG, banks and auto were relatively better off.

No new NFOs are currently open