Market Regulator SEBI on June 7,2021 introduced a mechanism called Potential Risk Class Matrix(PRCM) to educate debt fund investors. It defines a maximum quantum of risk a debt scheme can take. This PRC Matrix is calculated using interest rate risk and credit rate risk. It gives investors liberty to take informed decisions on the current risk level and the maximum risk which will be taken by the fund managers. Let’s start by understanding what these risks mean for an investor.

INTEREST RATE RISK - It is the probability of investment losses resulting from fluctuations in interest rate.

CREDIT RISK - Credit risk funds involve investing mainly in corporate bonds with a lower credit rating for a higher return. Credit risk is the probability of suffering a loss as the borrower may default on the principal and interest payments.

Why was PRC Introduced ?

This regulation was brought in due to the Franklin Templeton fiasco where the fund managers of debt funds invested in relatively risky debt to chase higher returns. Due to Covid-19, their schemes started facing an overall redemption pressure. They initially borrowed money to meet the redemptions, but that wasn’t sufficient. As a result, the fund house decided to freeze the debt schemes and eventually wind them up leaving their investors empty-handed.

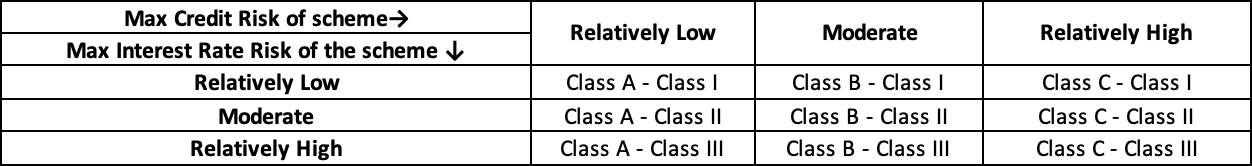

PRC Matrix (Potential Risk Class) :

For example, if an open ended Liquid Fund wants to invest in securities such that its Weighted Average Macaulay Duration is less than or equal to 1 years and its Weighted Average Credit Risk Value is 10 or more, it would be classified as a scheme with ‘Relatively low Interest Rate Risk and Moderate Credit Risk’. The position of the scheme in the matrix shall be displayed by the AMCs as under Class B - Class I.

Will the investor be affected due to this change?

The answer is NO, because these changes happen internally and all the funds work as it is. In fact, this will be an advantage for the new investors who purchase debt funds as they will be able to identify the maximum risk the fund manager will be taking.