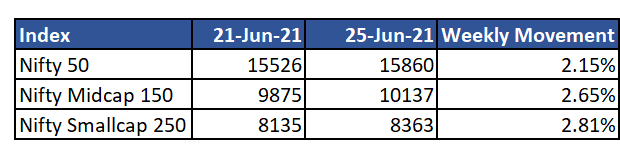

Markets ended close to all-time highs this week amid positive global cues. S&P 500 and Nasdaq hit lifetime highs this week despite inflationary and interest rate concerns. A key event this week was the Reliance AGM which was expected to lift indices higher. However, the stock fell over 3% after the AGM announcements.

Midcaps and smallcaps outperformed the broader index. Markets are expected to trade across a higher range going forward and will take signals from global markets and interest rate decisions of key countries.

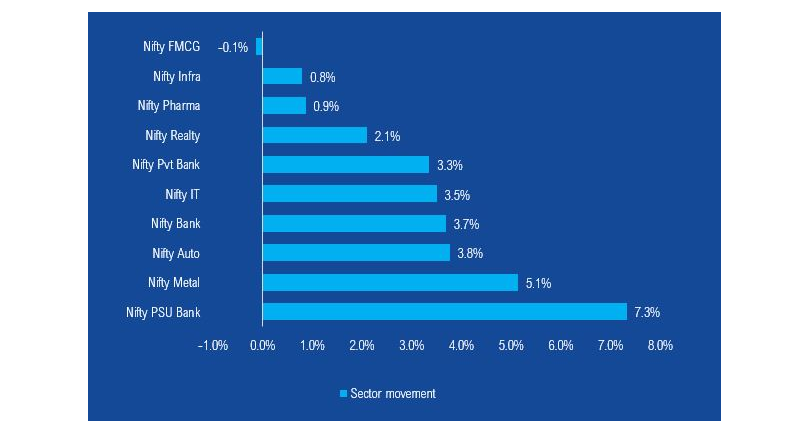

Banks, metals and auto outperformed the broader index. Metal stocks surged upon announcement of an infrastructure bill in the U.S which could result in increased demand of metals.

The outperformance in banking was led by a surge in some key public sector banks in the week. Shares of Central Bank of India and IOB hit upper circuits during the week due to privatisation anticipation.

Mutual Fund Industry Highlights

1. SEBI had set a limit of having maximum 10% exposure to a single bond issuer or stock. However, SEBI has removed this rule for interest rate swaps done through CCIL. Interest rate swaps are primarily used in floating rate funds. As the counterparty for fulfilling the obligation in these contracts is CCIL, SEBI has deemed them risk-free transactions and removed the limit.

This will also benefit funds who need to use these instruments since there is limited availability in the market for such complex products.

2. SEBI had previously announced that key MF employees would be paid 20% of their net salary in mutual fund units. SEBI has deferred the rule to be implemented from October 1, 2021 based on feedback received from key stakeholders.

NFO's currently open

- HDFC Banking and Financial Services Fund

- Tata Floating Rate Fund

- ITI Dynamic Bond Fund