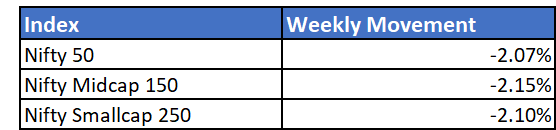

Markets experienced heavy selling through the week across all segments. Global inflation numbers and concerns of overvaluations were the main pain points dragging indices down.

Markets continued reacting to the high US inflation numbers. Due to all-time high inflation data in the world's most developed market, there is anticipation that Fed will start increasing rates sooner than expected. If the same happens and liquidity slows down, further short-term corrections can be expected.

On a more positive note, FIIs net purchased Indian equities in the week after being net sellers for the month of October.

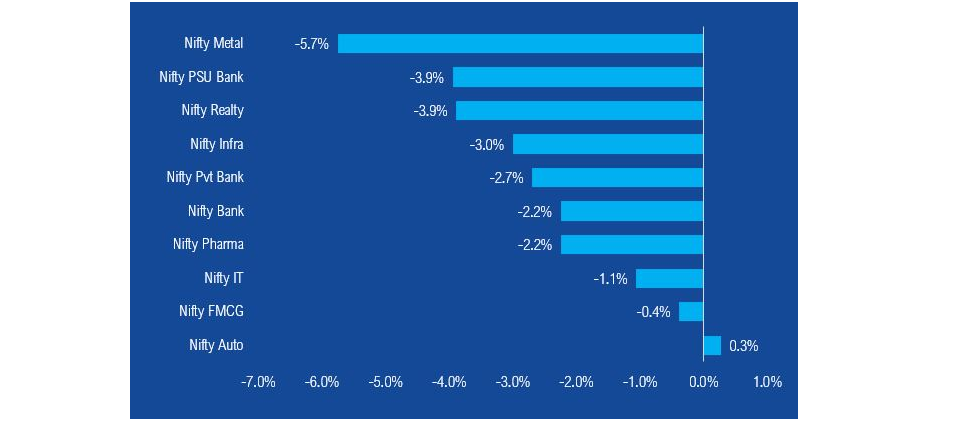

Metals and PSUs dragged the broader markets down as these counters experienced heavy selling. Selling in metals could be money moving from overvalued sectors to more undervalued themes as the rally in metals is usually cyclical.

Most other sectors fell in line with broader markets. Auto managed to remain stable even in such a volatile week, citing positive signals for the sector.

Mutual Fund Industry Highlights

AMFI releases October data

The mutual fund industry has received a net inflow of Rs. 38,275 crore in Oct 2021 as against a net outflow of Rs. 47,257 crore in Sep 2021.

27.11 lakh folios were added in the month of October and 23.83 lakh new SIPs have been registered.

NFO's currently open

- IIFL Quant Fund

- Quant Value Fund

- IDFC Multicap Fund

- Aditya Birla Sun Life Business Cycle Fund

- Axis Nifty 50 Index Fund

- Edelweiss Large & Midcap Index Fund

- ITI Banking and Financial Services Fund

- Motilal Oswal MSCI Top 100 Select Index Fund

- PGIM India Global Select Real Estate Securities Fund of Fund

- Mirae Asset Hang Seng TECH ETF Fund of Fund

- Tata Corporate Bond Fund