National Pension Scheme (NPS) is an investment cum pension plan launched by the Indian Government. This scheme is regulated and administered by the Pension Fund Regulatory and Development Authority(PFRDA). It is specifically launched by the Government of India to offer financial security to Indian senior citizens. NPS scheme provides impressive long-term savings options so that an individual can plan his/her retirement time efficiently by investing in this safe market-based plan.

Any citizen of India, whether resident or non-resident can join NPS, subject to the following conditions:

a) Individuals who are aged between 18-70 years as on the date of submission of his/her application to the POP/POP-SP.

b)The citizens either as individuals or as employee-employer groups corporates subject to submission of all required information and Know your customer(KYC) documentation.

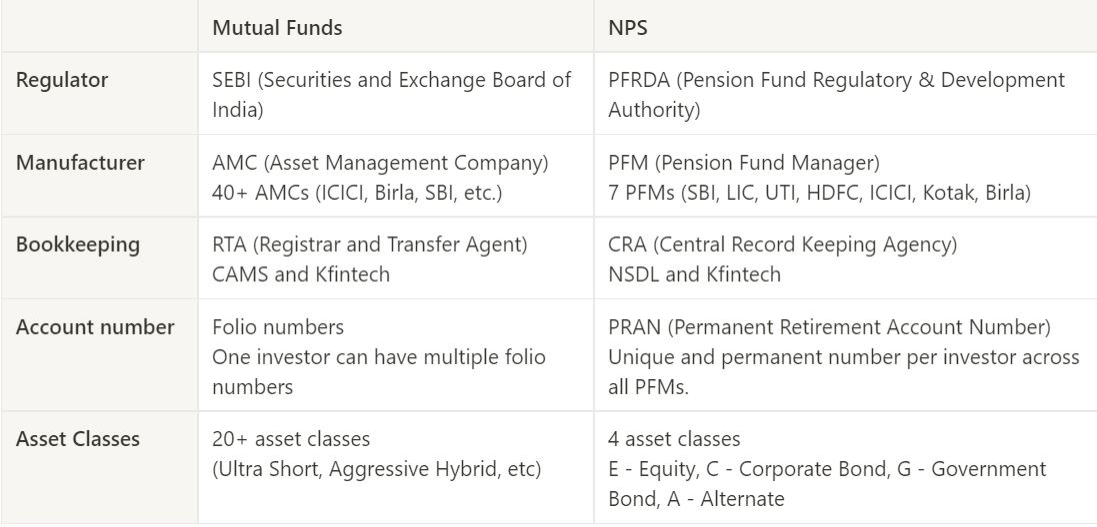

At present, there are seven Pension Fund Managers in the country:

- Aditya Birla Sun Life Pension Management Limited.

- HDFC Pension Management Company Limited.

- UTI Retirement Solutions Limited.

- SBI Pension Funds Private Limited.

- ICICI Prudential Pension Funds Management Company Limited.

- Kotak Mahindra Pension Fund Limited.

- LIC Pension Fund.

SBI Pension Fund, LIC Pension Fund, and UTI Retirement Solutions are the only fund managers who manage pension contributions of government employees under NPS.

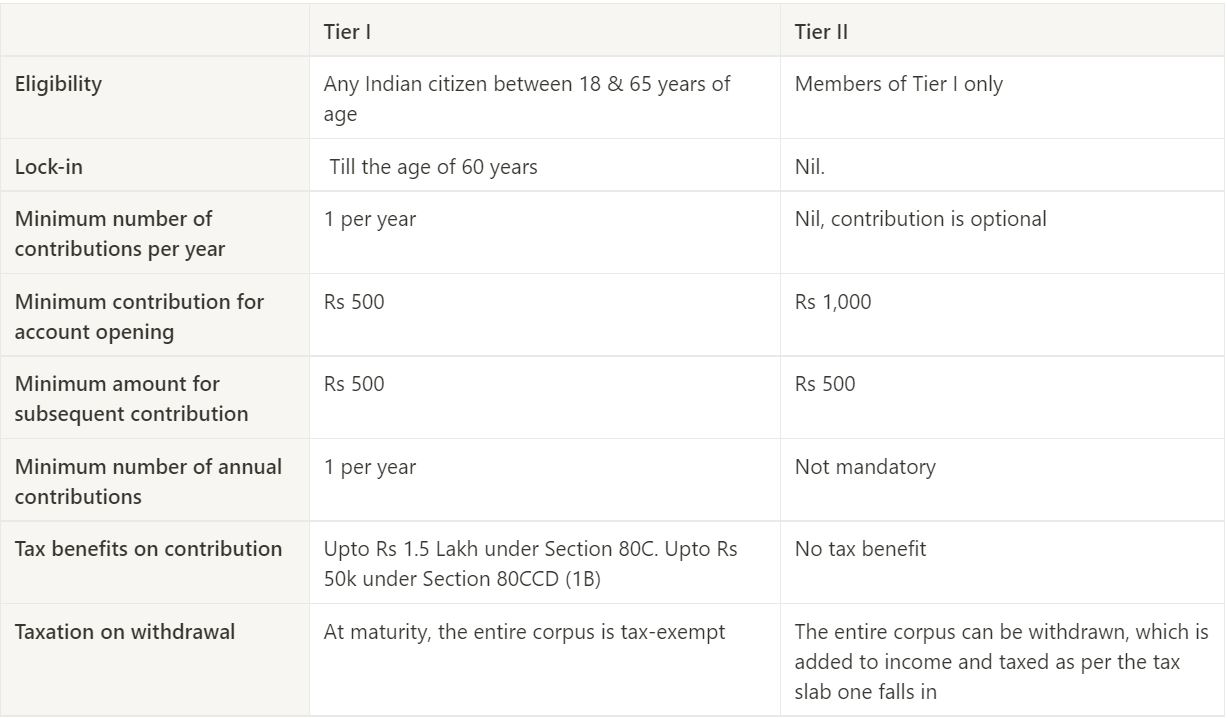

Different tier options in NPS

Under the NPS account, two sub-accounts – Tier I & II are provided.

Tier I:

This is the basic tier in NPS. It is a mandatory account. The investment amount is locked till 60 years of age. At the age of 60, 60% of the accumulated amount can be withdrawn, and the remaining amount will be paid out as a monthly pension. Only Tier I is eligible for tax exemption. This is a non-withdrawable retirement account that can be withdrawn only upon meeting the exit conditions prescribed under NPS.

Tier-II:

This is a more flexible tier of NPS, it’s a voluntary savings facility available as an add-on to any Tier-1 account holder. Subscribers will be free to withdraw their savings from this account whenever they wish. This carries no tax benefit. An investor needs to have a Tier I investment before they can invest in Tier II.

Investors of NPS need to choose one of the above tiers to make their contribution.

Investment in NPS is independent of your contribution to any Provident Fund or any other pension fund.

Comparison between MF and NPS

How to invest

a) Active choice – Here the individual would decide on the asset classes in which the contributed funds are to be invested and their percentages

NPS offers 4 funds to subscribers - Equities (E), Corporate Bonds (C) Government Securities(G), and Alternate Investment (A)

- Equity (E): Scheme invests predominantly in Equity market instruments.

- Corporate Debt (C): Scheme invests in Bonds issued by Public Sector Undertakings (PSUs), Public Financial Institutions (PFIs), Infrastructure Companies and Money Market Instruments

- Government Securities (G): Scheme invests in Securities issued by Central Government, State Governments and Money Market Instruments

- Alternative Investment Funds (A): In this asset class, investments are being made in instruments like CMBS, REITS, AIFs, etc.

NPS restricts investment towards Equities Funds to 75% of contribution amount for both Tiers I and Tier II NPS Accounts. However, subscribers can invest up to 100% in Corporate Bonds or Government Bank Fund.

Further, Investment in Alternate Funds is restricted to 5% of the contribution amount. The alternate Funds option is there for Tier I NPS account only.

b) Auto choice - This is the default option under NPS and wherein the management of investment of funds is done automatically based on the age profile of the subscriber.

There are 3 Life Cycle Funds - LC 75, LC 50, and LC 25.

These are also known as Aggressive, Moderate, and Conservative Life Cycle Funds respectively.

- Aggressive - LC75 In this choice, max 75% is given to E (equity) in the beginning and slowly moves to C and G near retirement age.

- Moderate - LC50 In this choice, max 50% is given to E (equity) in the beginning and slowly moves to C and G near retirement age.

- Conservative - LC25 In this choice, max 25% is given to E (equity) in the beginning and slowly moves to C and G near retirement age.

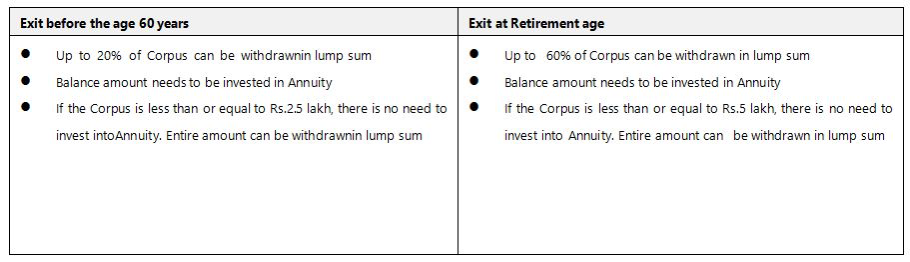

Payout and exit

The primary objective of the Tier – I NPS Account is to create a Corpus which can be used at the time of retirement to buy a pension for the Subscriber / Nominee. Hence, there is a restriction imposed on lump sum amount accessible to Subscriber on exit as mentioned below

In case of exit from NPS on retirement age, the Subscriber can defer the withdrawal option till 10 years depending on the market condition. Subscriber can withdraw this amount either in a lump sum or take the same in 10 installments before attaining the age of 75 years.

However, in the case of premature exit from NPS (before attaining the age of 60 years), the Subscriber does not have the option to defer the option.

To know about NPS or to invest in NPS before the end of this financial year, contact your financial advisor today!