Hike season is here

A new financial year is on us and around this time, companies usually give hikes and annual bonuses. Last year, due to the strain put on companies because of covid, bonuses and hikes in many companies were reduced or cancelled. There has been good recovery in earnings since then and companies are all set to compensate employees for the year lost.

Hikes and bonuses usually translate to higher monthly spending power, an extra vacation, down payment on a new car and so on. Along with all this, there is a case to be made to evaluate the benefits of increasing your investments and SIP’s with the surplus funds.

Why should you increase your SIPs

Maintaining savings ratio

Simply put, savings ratio is the savings/income. A healthy savings ratio is around 30 - 40%. Assume you have an income of Rs 80,000 a month. You save 25% or 20,000 of this every month. Post a hike your income grows to Rs 1,00,000. If you continue saving only 20,000 your savings rate drops to 20%. As you progress in your career, this number starts to look smaller.

By keeping your investments static while your income grows, your savings rate would become very small while your lifestyle expenses would keep increasing. Remember your monthly expenses are what determines your retirement corpus and consistently spending more would only make that goal amount tougher to reach.

Battling inflation

Inflation is the main reason we invest. By not investing, idle money depreciates over time due to inflation. In the same manner, by not increasing your savings, inflation catches onto them. A part of your returns are eaten up by inflation. By topping up your savings regularly, you can overcome the inflation effect and enjoy full returns on your investment.

Reaching the finish line sooner

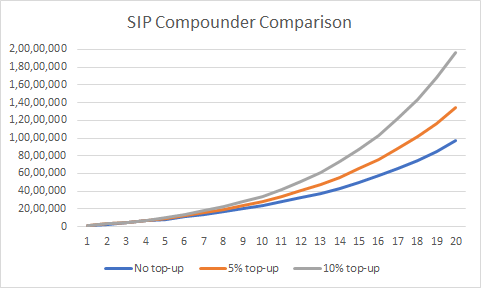

Regularly topping up your existing investments and SIP’s can help you reach your retirement or other long term goals faster. We have illustrated below how a small increase yearly can compound into larger returns over time.

How a 5-10% increase changes the game

We have assumed a monthly SIP of Rs 10,000, conservative return of 12% and compounded the investments over 20 years to see the difference a top-up makes. A 5% top-up every year increases the corpus by 40% over 20 years while a 10% top-up every year doubles the goal amount after 20 years.

The right amount to increase

A good rule of thumb is to increase SIP’s at par with inflation so around 5-6%. A better result would be to increase SIP’s in line with the increase in income. A 15% hike in salary means an additional 15% surplus every month. 5% of this can be accounted for inflation related increases in monthly expenses. The remaining 10% can be used to increase savings.

Increments to investment must be made keeping other factors like emergency reserve, loan obligations and short term commitments in mind. Consult your financial advisor to know what is the right amount of investment top-up that makes sense for your financial journey.