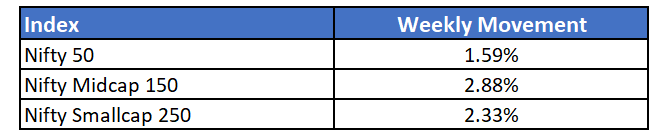

While largecap indices traded close to lifetime highs, small and midcaps touched new lifetime highs during the week led by a positive monetary policy, decent growth numbers and reducing inflation concerns.

A key event this week was the RBI Monetary Policy. RBI kept rates unchanged and maintained the status quo on accommodative stance. FY22 GDP growth was maintained at 9.5%. CPI forecast was also lowered from 5.7% to 5.3%. Lowering inflation concerns signals that a rate hike can be postponed for some more time without causing much economic stress.

The committee also reiterated an accommodative stance to support sufficient liquidity and financial stability signalling positive cues for equity markets.

Globally, US private sector employment data showed a spike in the month of September and yields softened.

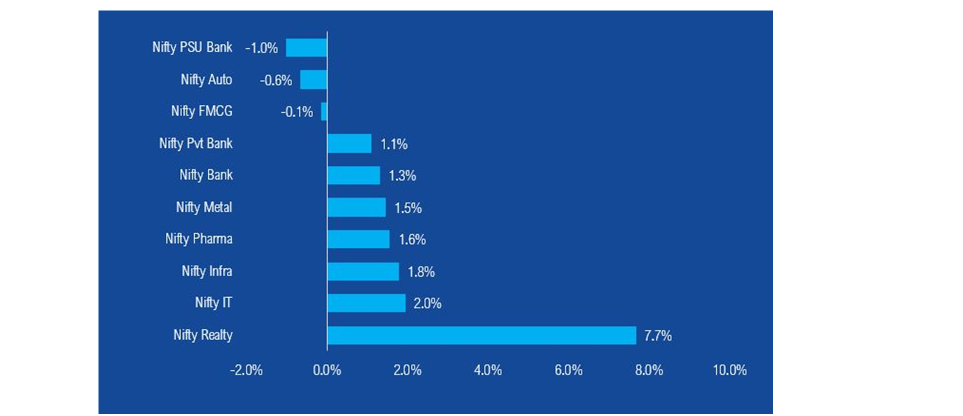

Realty index continued its upward rally to touch new highs in the week. The index hit a record high as the expectations of healthy quarterly results push-up the indices.

TCS announced fairly positive results during the week, creating anticipation for positive numbers from other IT peers as well. The index shot up 2% in the week as a reaction to the same.

Mutual Fund Industry Highlights

AMFI releases September MF data

SIP contribution rose to a new high and crossed Rs.10,000-crore landmark for the first time. New SIP registrations also scaled a new peak of 26.79 lakh.

Industry AAUM went up by over Rs.1 lakh crore to Rs.37.4 lakh crore in September to hit a new all-time high. In August, the AAUM was Rs.36.09 lakh crore.

Total number of SIP accounts has risen to 4.48 crore from 4.32 crore in July

However, the industry registered net outflow of Rs.47,257 crore in September due to high redemptions from debt funds. According to AMFI CEO NS Venkatesh, such redemptions are usual in September as it marks the end of the first half of a financial year, when corporates make advance tax payments.

NFO's currently open

- ICICI Prudential NASDAQ 100 Index Fund

- Mahindra Manulife Asia Pacific REITs FOF

- Axis AAA Bond Plus SDL ETF - 2026 Maturity Fund of Fund